While the titles indicate that this software does similar tasks, you should evaluate the features of FreshBooks vs QuickBooks before deciding which to use. Although these two choices have many of the same characteristics, they do not operate in the same manner.

FreshBooks, for example, manages invoicing for small firms and freelancers, whereas QuickBooks is accounting software for organizations of all sizes.

We evaluated FreshBooks versus QuickBooks from several angles, including functions, connections, and cost, to put the debate to bed once and for all. By the conclusion, you’ll be able to specify the instrument that best meets your requirements and fits your price.

So, without further ado, let’s get this party started.

Table of Contents

Introduction to FreshBooks vs QuickBooks Online

While small businesses may eventually exceed QuickBooks Online, the platform can only support up to 25 users, so it may take some time.

Also Read : A Detailed Comparison of Quicken vs QuickBooks

When to Function QuickBooks?

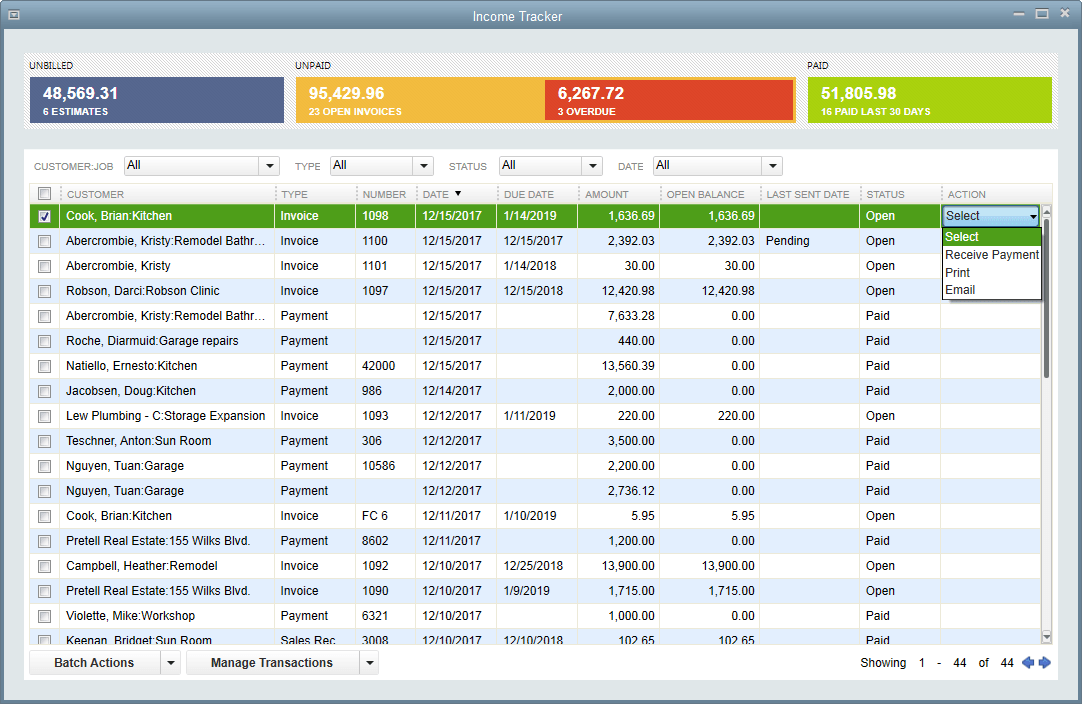

QuickBooks is the finest small company accounting software because it has more capabilities than FreshBooks, such as inventory management, spending tracking by class and location, and the option to create reports on either the accrual or cash basis of accounting. In addition, QuickBooks provides a wide network of QuickBooks ProAdvisors that may access your online books with your consent to assist you to resolve difficulties and keeping your books clean.

How is QuickBooks Online Better?

Look below for the factors determining how QuickBooks Online is a better choice.

-

Manual bookkeeping

Select QuickBooks if you wish to manually import your bank files or enter transactions. If you don’t give FreshBooks access to your bank account, it won’t be able to reconcile your accounts. QuickBooks allows you to link your bank, but it is not required.

-

Inventory

When you use QuickBooks Online Plus or Advanced, you can keep account of stock products and volumes, regularly update pricing and quantities, and calculate the cost of goods sold (COGS) when a sale is made.

-

Sales and Taxes

QB Online recalculates sales taxes in any location for simple tax filing. You must set up the sales tax for each district where you physically raise revenue in FreshBooks.

-

Purchase and Sales :

All QuickBooks or FreshBooks can manage bills, although QuickBooks’ accounts payable (A/P) tools are more advanced. To assist you to optimize your procurement procedures, QuickBooks allows you to produce purchase orders (POs). The incapacity to generate POs is one of FreshBooks’ drawbacks.

Also Read : Owners draw QuickBooks: Meaning & Setup

FreshBooks Online

FreshBooks was created with single proprietors in mind, so it’s ideal for professionals like attorneys, architects, plumbers, designers, and anybody else who works alone. On the other hand, maybe utilized by developing enterprises thanks to its four plans.

It is an excellent solution for folks who are new to the company. It makes running a business a snap.

How is FreshBooks Better?

Brief to know Why and how FreshBooks is a better option.

-

Business on Project-Based

FreshBooks allows you to send invoices to clients, keep track of project time, and analyze expected and real spending for improved financial planning.

-

Customer Service

This program is one of the few bookkeeping software companies that enables you to speak with a customer support person over the phone. You can also call QuickBooks for help, but you can’t make the call yourself. You must fill out a ticket and wait for a call from an operator.

-

Affordability for QuickBooks:

FreshBooks is a more cheap option than QuickBooks if you’re a lone entrepreneur or a very small firm with one or two workers.

Essential Elements of QuickBooks Vs FreshBooks

Let’s take a more intimate look at QuickBooks vs FreshBooks. Now you have better understanding about both of them. We’ll look at characteristics in particular:

-

Timekeeping

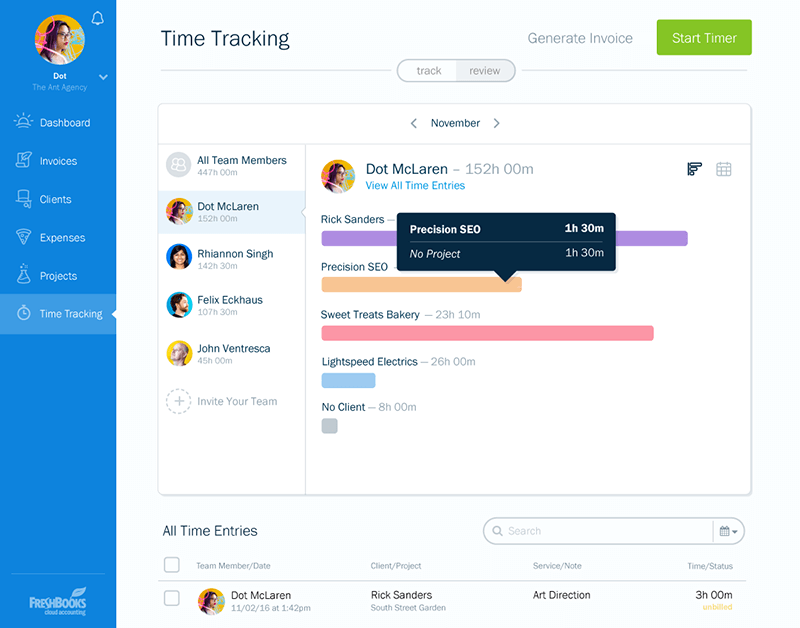

FreshBooks has time management integrated into it, which is useful for project and specific instance organizations where staff monitor paid hours along with other project expenditures. These hours’ monitor and task views assist you in keeping your entire project and individual staff on the task at the appropriate times.

Once you’ve collated the data, you’ll most certainly transfer it into your accounting system, depending on the size of your workforce.

-

Accounting

QuickBooks or FreshBooks is created for freelancers, hence the most of its functions revolve around client billing. The QBs accounting portion is mainly for billing of product.

- General ledger

- Trial balance

- Chart of accounts

- Balance sheet

- Accounts payable

- Cost of goods

- Journal entries

- Accountant access

For an exact profit & loss report, FreshBooks provides double-entry accounting tools.

As per the accounting point of view, QBs gives greater company information. You may acquire a full report of cash flow to help you with your tax preparation. You can optimize discounts and keep compliant with tax rules using the built-in phone device.

In addition, finance connections such as budgeting, inventory management, forecasting, vendor billing & crediting, purchase orders, & form 1099 are available, which are not available in FreshBooks.

-

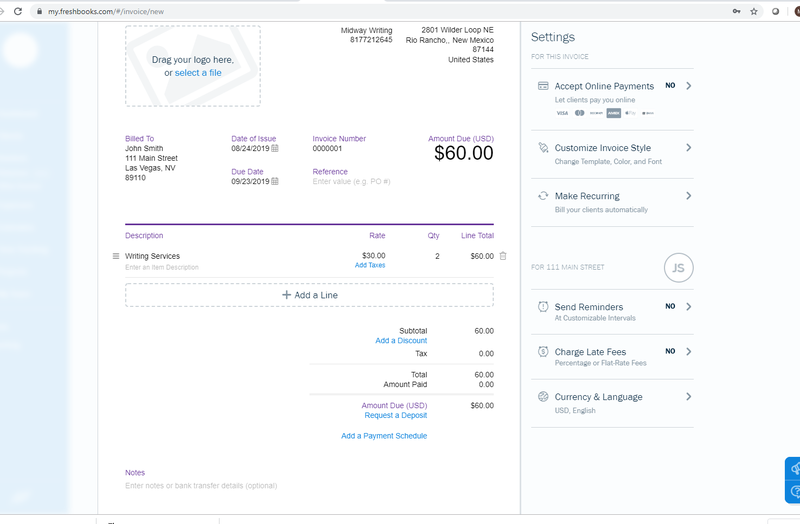

Invoicing

To monitor paid hours and put them on your invoices, QuickBooks integrates to select third-party time tracking programs like Google Calendar or TSheets. QuickBooks’ invoice builder has a different modification option, so you may customize the look of your invoices before sending them to clients.

Add a click-to-pay toggle on your invoice so that your customers may pay right from the invoice, and use the platform to schedule reminders and regular payments.

This Program also provides a click-to-pay option for online bills, as well as a configurable invoice style. If you identify your hours as “billable,” the invoices will extract data straight from the timekeeping function. Recurring bills and automatic billing of billable hours, as well as follow-up emails for late payments, are examples of automated processes.

-

Tracking-Time

FreshBooks is far superior to QBs if it comes to monitoring. It is an integrated system both accurate and user-friendly. However, it will start recording time when you press the “start timer” box. When you’re finished, click the button to produce invoice, and hourly data will be instantly included in the invoice.

QBs lack that capability. Nevertheless, you may utilize TSheets time monitoring, a QuickBooks software, to add feature. It includes features like paper timesheets (actual-time work-checking), exact employee timesheets, & mobile access.

-

Expense Tracking

QuickBooks includes both debits and credits, so you can keep a record of your profitability at all times. Since QB is built to present line items rather than more detailed breakdowns, this may need an additional manual entry on your (or your accountant’s) part.

Because FreshBooks is primarily used for invoicing and payment collection, you may need to acquire or connect to another accounting system. It does, however, have unique expenditure capabilities such as receipt monitoring, project time tracking, and sales tax management.

Ease of Doing Business with FreshBooks Versus QuickBooks Online

FreshBooks or QuickBooks or FreshBooks both feature intuitive interface design. They both employ basic terminology across the application so that anybody with no prior experience in accounting or bookkeeping may use it.

FreshBooks –

FreshBooks makes it easy to start a business in just a few moments. After entering some basic info about your firm, such as its name, email, and mobile number, you may begin exploring your new FreshBooks a/c. Your Account receivable balance, overall earnings, & a menu bar which is available on the left side for ease of browsing inside the application are all displayed on the FreshBooks dashboard.

Another important feature of FreshBooks is to Create a New button which permits you to instantly create invoice, a client, estimate, bill & other items.

QuickBooks –

QBs Online is not as simple to set up as FreshBooks, but when you do, the default interface is configured to provide you access to important operations as well as a general view of your company. All of QBs Online’s major services, including Sales, Banking, Cashflow, Projects, Expenses, and Payroll, are accessible from the dashboard’s left menu bar.

The +New is a highly useful tool that allows you to quickly record a transaction. You may examine your paid & outstanding bills, total costs, profit & loss, and total sales for any period rather than running a report.

The good thing is that, based on your membership level, both systems feature limitless customer assistance to assist you in learning related to the software.

Price Rates of FreshBooks and QuickBooks

Finally, we’ll evaluate FreshBooks vs QuickBooks price so you will see the cost of individual tools. FreshBooks is often however, it varies based on the package that you desire.

QuickBooks Pricing:

QuickBooks charges a somewhat higher fee. The base plan is available for one person, whereas greater subscriptions are required for sophisticated services like inventory monitoring, profit prediction, and timesheets.

- Start price – $25 per month

- Plus – $70 per month

- Advanced – $150 per month

If you wish to adopt QuickBooks as a freelancer, you may pay $15 per month for their QuickBooks Self-Employed plan.

FreshBooks Pricing:

It has a various pricing levels for freelancers & businesses. Their price packages differ based on the number of chargeable clients, extra tracking & reporting capabilities.

- Lite – $6

- Plus – $10

- Premium – $20

- Choose – For 500+ chargeable clients, talk to sales

It’s not quite FreshBooks, but it’s near. Note that, while QuickBooks Online is somewhat affordable than FreshBooks initially, the price of QuickBooks Online often rises after the first three months, whereas FreshBooks pricing does not change monthly.

Wrapping Up!

FreshBooks is a preferable option for tiny and one-person enterprises, whereas QuickBooks is a superior all-around accounting application for businesses of all sizes.

We hope that the information provided in this post has answered your questions. Visit our website for more such articles.