If you’re looking for a comparison between TurboTax Basic vs Deluxe you certainly are at the right place for all the information. TurboTax is software that helps user file their federal and state taxes, and it comes in several versions, each designed for specific financial and tax situations.

The most difficult part is choosing the right TurboTax version. You don’t want anything to happen, other than an audit. You can exalt if that happens but it can be more pricey.

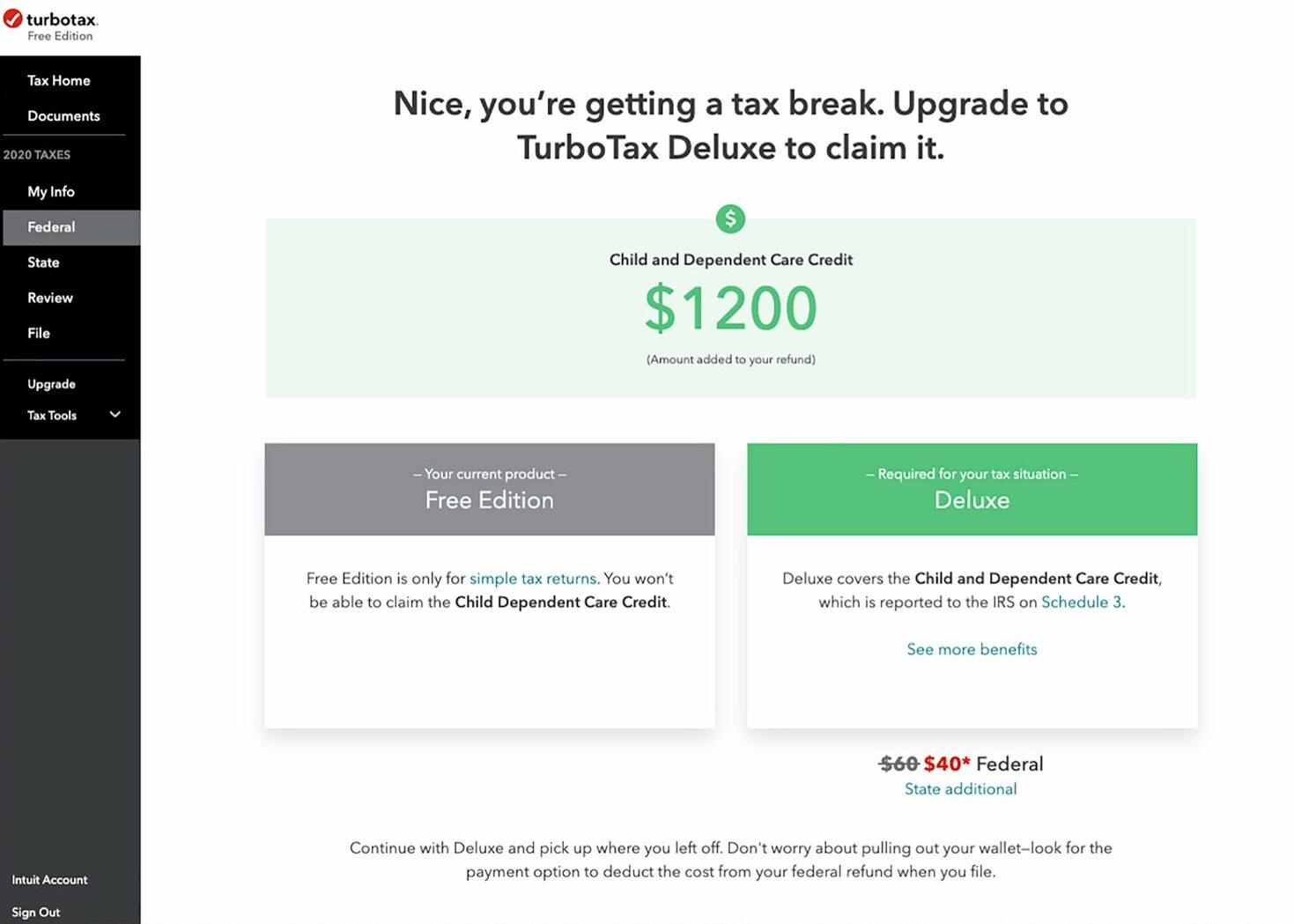

TurboTax Free Edition may be available for those who have the same primary tax returns and can file them. Yes, free! This is additional to the IRS Free File program, which was free after 20 years of participation. TurboTax created its – free TurboTax edition. This program is ideal for simple returns.

Therefore, it’s best to decide the TurboTax version will meet your requirements most useful at the start, then purchase the appropriate version at the start. There is a possibility that you could file using TurboTax without cost!

Table of Contents

Elements of TurboTax | TurboTax Basic vs Deluxe

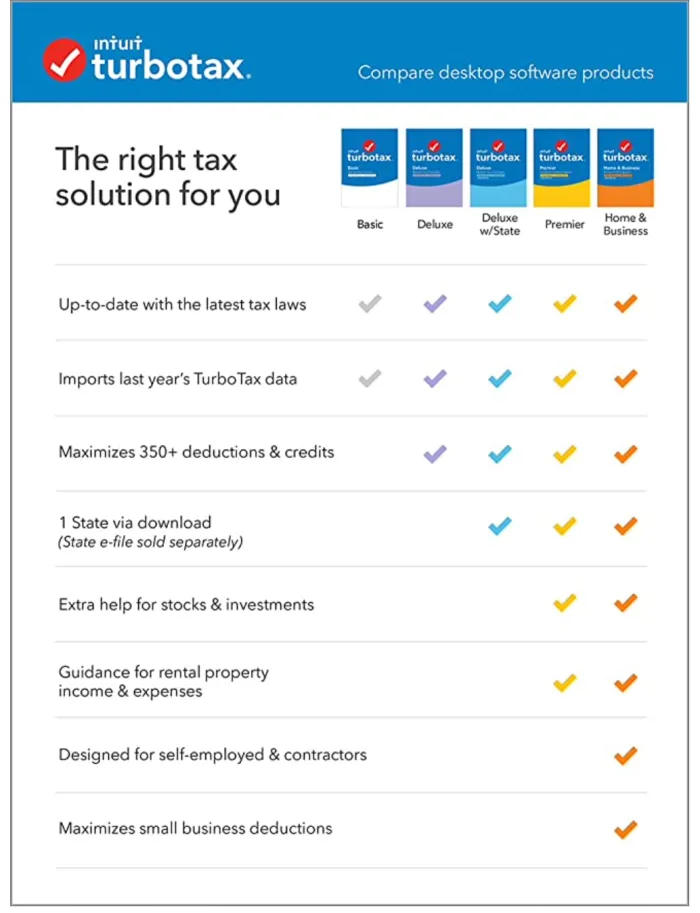

TurboTax comes in two versions. Both versions include online help and IRS forms. There is also a combined accuracy-checking program to ensure you are adding up everything correctly.

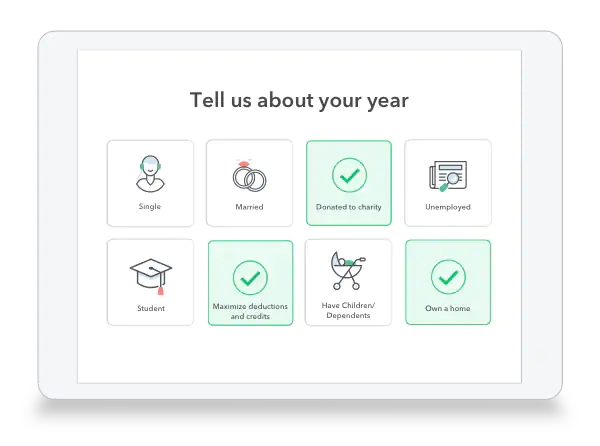

TurboTax Deluxe comes with some additional features. It scans your data to find any other inferences or credits that you might not know about. There are also options for entering data about shifts in your finances, career, or assets over the past year.

Suggestions for Picking a Version of TurboTax

After rigorous research and combining the reviews, here’s information based on the data from TurboTax Forums.

- Track Intuit’s guidance about which version you should choose if you want uncomplicated, easy filing and are willing to pay for it.

- You don’t need to use the Home & Business Version if you are self-employed. Instead, you can use TurboTax Deluxe Version (PC/ Disc or Download). You can also fill out Schedules C and SE in Forms Mode or by mail. Intuit recommends Home & Business, but it is not a requirement. It might be simpler to use TurboTax Home & Business, and you can avoid any upgrade requirements.

- TurboTax Deluxe will suit your needs if you have premises such as those related to owning a house or expenses associated with your job.

- TurboTax Free File is available to anyone who has very little tax filing requirements and can file a basic tax return. Remember to complete your tax return by 2/15/22 to benefit from this program.

- TurboTax Premier and TurboTax Home & Business are the best options if you own rental property or deduct stock and investment deductions.

- TurboTax Home & Business is the best choice for self-employed contractors and home-based business owners. TurboTax Home & Business maximizes your home deductions.

- If you are looking for a more affordable version than Intuit guides, avoid the online versions. Instead, download the CD/download versions. You can still print the forms and submit them by hand, but this does not guarantee e-filing.

Ease of Doing Business with TurboTax

TurboTax’s interface functions as a talk with the tax skill. You can also miss around if required. The banner at the sideshows you where you are in the procedure. It also flags areas that you need to meet.

You can find tips and explanations embedded throughout the technique. Help buttons are a way to connect to a searchable knowledge base, on-screen service, and many other resources.

Few Important Parts

- You may switch to another provider: Tax can import PDFs which are electronics(not scanned copies of the hard copies) of the tax returns from the H&R Block & Liberty Tax, Credit Karma, and Tax Act.

- Platform mobility TurboTax allows you to check & work on returns across multiple devices, including your computer, tablet, or phone.

- Import certain documents of tax automatically: If your employer has a partnership with the TurboTax you can import W-2 info. However, you can likewise take a photo of the W-2 which belongs to you to upload your data onto your return. Certain 1099s can be imported, while the version of self-Employed allows you to upload the 1099-NECs directly from clients. You can also import income & expenses from Square and Uber.

- Donation calculator All packages, including the Premier, Deluxe, & Self-Employed, include ItsDeductible. This feature is a standalone mobile application that allows you to quickly find out the value of clothes and home commodities donated.

- Crypto support. TurboTax Premier eliminates the most frustrating part for crypto investors, manual access. You can also import up to 4000 dealings at once.

- Platform mobility TurboTax allows you to check and work on returns across multiple devices, including your computer, tablet, or phone.

Read: How to resolve QuickBooks TurboTax Error 42015

TurboTax Deluxe Edition

TurboTax Deluxe vs. basic Edition was used later when our children were older and had more types of deductions. You get all the basic features, plus Deduction Maximizer which searches for more than 350 deductions and credits. ItsDeductible will also help you to accurately esteemed charitable donations.

TurboTax Deluxe retains many tax forms but is not prepared. However, this does not include the cost of e-filing the state recovery.

Pricing of TurboTax Basic vs Deluxe

TurboTax Basic Vs Deluxe 2015 has more functionality, but a higher price. TurboTax Basic was priced at $34.95, TurboTax Deluxe TurboTax was $49.95 and each state tax filing cost was added at $49.95.

Although it may not be a pleasant idea to send finances to the IRS or pay more for filing, it is likely worth it if your taxes have been complex enough to warrant TurboTax Deluxe.

Audit and Financing Threats

TurboTax Deluxe also includes an accuracy checker on both versions. It also has the Audit Risk Meter which analyzes your information and provides suggestions for lowering that chance.

Users are also warned by the program if they enter any information that could lead to an audit. This is very helpful for those with more complicated financial situations, who are more at risk of creating errors or being audited.

Analysis and Criticism of the TurboTax System

Turbo Tax Basic Vs. Deluxe gets better and more information about your acquisitions, employment, education, and history is easily seized in its interface. You start to wonder what it would be like if this process were not only automated but also free and accessible to everyone.

Some middle eastern nations have this capability. The government collects the data and then “populates” tax forms from it. It’s as easy as signing it off. This is why we don’t offer such a method.

Wrapping Up!

TurboTax’s reflexive format and a variety of support options make it the industry standard in tax preparation. TurboTax’s products are expensive, but confident filers may find similar offerings at a lower price.

We hope you liked the article and contemplate now all about the TurboTax with all the information provided to you.

Frequently Asked Questions

Q1 .Explain TurboTax basic vs premier ?

TurboTax Basic is ideal for those who have fairly simple tax situations. It can be used to file both state and federal taxes, and it includes support for common deductions and credits. TurboTax Premier, on the other hand, is designed for those with more complex tax situations. In addition to state and federal taxes, it can also be used to file taxes for self-employment, rental property, and investments.

It also provides resources for understanding tax laws and maximizing deductions. As a result, TurboTax Premier is generally a better choice for those with more complicated financial lives.

Q2. What is TurboTax self-employed ?

TurboTax Self-Employed is a comprehensive tax preparation solution designed specifically for freelance workers and small business owners. It offers a wide range of features to help users maximize their deductions and get the most out of their tax return. The software searches for industry-specific deductions that are personalized to the user’s line of work, ensuring that they get back every dollar they deserve. It also offers guidance on completing complex tax forms, such as the Schedule C, and provides access to experts who can answer questions and provide assistance.