It’s 2022 and TurboTax remains at the top as high-quality tax software. Its File import, Crypto transactions support, and Integrations with various financial companies make it a feature-rich yet very simple to use tax software option in the market.

However, as good as Tax software may become, there are some drawbacks that may make a user reconsider purchasing it. In this regard, we are going to do TurboTax review and mention all the features, drawbacks, pricing, as well as benefits and disadvantages. So, let’s begin.

Table of Contents

TurboTax Review: Is it suitable for you?

When it comes to tax preparation and filing, TurboTax performs well and covers all of your needs. If you’re self-employed with a mortgage investment account, bank interest, and other factors, you’ll feel confident doing your taxes with TurboTax.

While TurboTax isn’t the cheapest option available it is worth the price you pay for. Its customer service, forms, and simplistic interface give you the certainty that you get an accurate tax refund resulting in maximum cash for your pocket.

However, there may be people with simple taxes that will be better off with a cheaper option, and there might be some people who feel more comfortable hiring an accountant to do their taxes.

So, when deciding whether it’s suitable or not, it depends on a person’s choice but if you’re looking for Tax Filing, Guidance on Audit, and Maximum Tax Returns then Turbotax is suitable for you.

How does Intuit TurboTax help you?

TurboTax combines all the information that most taxpayers need to file taxes and then helps you prepare tax reports and file taxes to get the maximum returns possible.

TurboTax has two versions of its software: an online version and a desktop version available to install. Its prices vary depending on what tax filing requirements you have. Furthermore, TurboTax’s mobile app for iOS and Android allows you to log in and start working on taxes from anywhere.

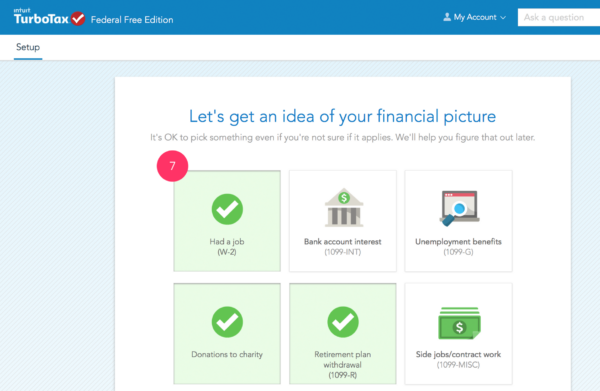

Just like other tax filing programs, TurboTax asks questions and answers regarding your household and income to ensure you do not miss any opportunities on deductions and credit. You’ll also need to provide information about your employer, income sources, W-2, 1098, 1099, and other forms that may appear in your inbox.

| You might like TurboTax if you: |

| – Qualify for $0 in state and federal filing. |

| – Need help with tax matters, deductions, and forms. |

| – Want Step-by-step guidance for taxes. |

| – Wish to track business expenses with QuickBooks. |

| You might dislike TurboTax if you: |

| – Are you a student-loan borrower or just a college student looking for a free alternative. |

| – Trying to find a low-cost solution for your taxes. |

Is Turbotax Free or do we have to Pay?

Turbotax comes with a free edition as well as with paid ones. The free edition allows you to pay taxes for federal and state returns.

However, with paid ones, you get a lot more features. We’ve reviewed all of the editions of Turbotax for you. Let’s check them out.

TurboTax Free Edition

| Free – Federal & State Returns |

| TurboTax Free Edition allows you to file both federal and state taxes free of charge. If you only have a basic tax return, we believe, this edition will be perfect for you. |

| This would allow you to report only W-2 income, limited interest, dividend income, and claim the standard deduction, child tax credit, and earned income tax credit. |

TurboTax Paid Software Editions

| Deluxe Edition |

| $60 – Federal Return | $50 – State Return |

| TurboTax Deluxe searches for more than 350 tax credits and deductions to find the ones that you are eligible for. Deluxe will ensure that you receive the maximum tax refund. |

| It also provides personalized support from a customer representative. You will also be able to access Turbo online, which helps you assess your financial situation. |

| Premier Edition |

| $90 – Federal Return | $50 – State Return |

| TurboTax Premier was completely redesigned to provide investors with the best experience. You can incorporate bonds, stocks, ESPPs, Robo investing, cryptocurrency as well as rental income, and many other items into your return. |

| It will allow you to easily record all your investments transactions appropriately and also import more than 1,500 transactions from at least 300 financial institutions. Furthermore, it also supports approx 2,000 crypto transactions from crypto platforms. |

| Self-Employed Edition |

| $120 – Federal Return | $50 – State Return |

| TurboTax Self Employed uncovers industry-specific deductions that you might not know you were qualified for, whether you’re a freelancer or just starting to make money from your side hustle, it can reduce your taxes and help you put more money in your pocket. |

| This product is focused on online sales, ride-sharing, and personal as well as professional services. Furthermore, it also covers other industries where many people are self-employed. |

| Also get guidance on reporting expenses such as cell phone charges, home office equipment, mileage, and phone charges and import your 1099 form from your mobile by taking a picture of it. |

TurboTax Paid Live Editions

| TurboTax Live Basic |

| $50 – Federal Return | $45 – State Return |

| TurboTax Live Basic allows you to connect via one-way video with a TurboTax Live Tax Expert who has an average experience of around 15 years. This will help you get all your answers. |

| TurboTax Live tax specialists are available all year in English and Spanish. They can review your tax return and assist you with filing it. |

| TurboTax Live Deluxe |

| $120 – Federal Return | $55 – State Return |

| TurboTax Live Deluxe allows you to do all that is possible with TurboTax Live Basic including the Turbotax stimulus. However, you can now also talk to a tax expert about over 350 credits and deductions including the charitable contribution and mortgage tax deduction. |

| TurboTax Live Premier |

| $170 – Federal Return | $55 – State Return |

| TurboTax Live Premier allows you to connect via one-way video with a TurboTax Live Premier tax specialist who can offer guidance and advice on almost any investment tax situation. |

| It includes bonds, stocks, cryptocurrencies, Robo-investing, rental property income as well as ESPPs. You can do auto-import of your investment a/c and income for losses and gains from crypto transactions. |

| TurboTax Live Self-Employed |

| $200 – Federal Return | $55 – State Return |

| The Live Self Employed service of TurboTax offers live tax advice to contractors, freelancers, small business owners, and other individuals. |

| The live support will help you identify all deductions that are available, perform an audit assessment and evaluate your income. |

| TurboTax Live Full Service |

| Prices vary |

| TurboTax has added Live Full Service to its feature for the 2020 tax season. It allows you to upload your documents to have a TurboTax tax expert prepare and file taxes for you. Prices will vary depending on the tax return. |

Benefits that TurboTax offers

1: Guidance on crucial tax forms: TurboTax will tell you exactly what you must fill out to file your taxes as per your particular circumstances. You’ll get step-by-step instructions and guidance for most tax forms.

2: Get your refund in multiple ways: There are many ways to get your federal refund. You can have it deposited in your bank account, sent by check, or loaded onto a debit card. Turbotax card offers refund advance loans in the first tax season.

3: Get connected to Credit Karma’s checking account: Although the Credit Karma a/c is not made widely available, TurboTax users are eligible to sign up once they have filed. There is no fee for the account and there is no minimum deposit.

4: Import and upload tax forms: Many tax forms can be imported directly from investment banks or banks. The mobile app allows you to take a picture and upload the supported forms. Also, you can now upload tax returns from the previous year.

5: Extensive help resources: Get Support and help resources for most tax questions with clear and understandable advice.

6: Accuracy guarantee. TurboTax will pay the IRS penalty and fees for calculation errors. However, this guarantee becomes null if found that you have entered incorrect information.

7: Live support is an upgrade option: You can pay extra to talk to an expert in just a few clicks or give your documents to professionals who can complete everything.

8: Mobile version: With the TurboTax Mobile version, you can prepare and file your taxes with more ease. It is available for TurboTax online editions.

9: Tax return storage. TurboTax can store your submitted tax returns in your account for a period of seven years.

Is TurboTax Trustworthy and Safe?

While using any software especially the one with taxes, the first thing that comes to mind is if it’s trustworthy and safe. TurboTax protects your data with data encryption. Furthermore, to verify your identity, Multi-factor authentication is required every time you log into TurboTax.

However, TurboTax’s ease in upgrading users to the next-tier product is one of its biggest flaws. An investigation done by ProPublica’s 2019 revealed that TurboTax’s parent company Intuit was intentionally hiding its free filing services from Google and other search engines. Fortunately, TurboTax’s free filing options are now clearly visible.

Moreover, TurboTax is the leader in tax preparation services and it offers services that make millions of people return year after year. TurboTax makes it easy and simple for them to file their taxes.

You just need to follow the instructions and correctly enter your income numbers, and you will get accurate taxes as if you hired a professional tax preparer. So, yes with the support of millions of users, Turbotax is totally trustworthy and safe to use.

Also Read: Simple & Effective Steps to Install TurboTax on Mac

Key Features

TurboTax is the most user-friendly and reliable tax filing software available today. Its user interface is unrivaled and it is equipped with the following features:

1: Hundreds Of Integrations: TurboTax works with hundreds of partners for official integration. TurboTax will connect to your W-2, 1098, or 1099 form. From any of these partners, your Turbotax can transfer information. These integrations can reduce the time required to submit your tax returns.

2: Question And Answer Guidance: TurboTax’s simple question and answer model assists you through the software. Believe us, you won’t feel screen fatigue while answering the questions.

3: Assistance From Tax Experts Is Available: TurboTax offers a costly upgrade option that allows filers the opportunity to work with a tax expert. TurboTax login users can ask tax experts questions and receive accurate returns.

4: Official Cryptocurrency Support: The only tax software that officially partners with cryptocurrency accounting software, TurboTax is a boon for Crypto holders. Coin base users have the ability to import transactions directly from their accounts.

5: Excellent Calculators: TurboTax offers excellent calculators that can help filers claim their depreciation expenses. It also offers reliable retirement contribution calculators, which flag problems when filers over-contribute to their retirement accounts.

6: No Jargon: TurboTax simplifies tax filing by removing tax jargon. Information bubbles and explanations allow anyone to use the more complicated features, such as expense calculators or depreciation.

Major Drawbacks

While reviewing TurboTax we only found a few drawbacks that may not appeal to all users. Let’s discuss them:

1: Limited Free Filing: TurboTax’s free filing is only available to individuals with Social Security income and W-2s. You won’t be eligible if you have unemployment income for 2021 (even if you were qualified in 2020).

The free filing option is not available to HSA holders or those who have child care expenses and upgrading costs a lot.

2: Expensive Paid Tiers: TurboTax software is the most expensive on the market. Those who value its integrations and benefits might decide that it is well worth the cost. However, there are many people who’ll look for an alternative for a much lower price.

3: High-Cost Audit Support: TurboTax Free edition includes audit support. However, if you need this support at the Deluxe or higher levels then you’ll have to pay $60 for MAX support.

Must Read: A Detailed Comparison of Quicken vs QuickBooks

What Comes Under TurboTax Warranty?

In case you don’t know that every TurboTax return comes with guarantees, check them below:

1: Expert-Approved and 100% Accurate Taxes: TurboTax will correct any errors made by a TurboTax tax expert while providing specific tax advice. It will also amend your return free of charge to address the IRS or the state penalty.

2: Audit Support Guarantee: TurboTax’s Audit Support Center provides free audit support all year. It helps you discover the reason IRS reached you and what you can do to respond.

3: Get Maximum Refund or your Money Back: If you get a higher tax refund or owe more taxes using another method of tax preparation, TurboTax will cover the federal or state price paid.

4: 100% Accurate Calculations: In case the TurboTax calculator problem leads to a state or IRS penalty, TurboTax will pay it.

We believe, our review helped you understand how Turbotax works and its effectiveness in benefitting from taxes.

In addition, our review is based on testing made by our experts, and all the features, drawbacks, as well as pricing, are carefully researched for accuracy.