If you are planning to grow your business, then QuickBooks will help you in every way. This accounting software helps the organization and the business owners to keep track of their cash inflows and outflows and ensure the profitability of the company. This software also assists with the crucial financial decision of the organization. After all such features, many users want to know more about “what is QuickBooks?” and how it can help their businesses.

In this detailed guide, we will cover everything about QuickBooks. From its history to how it helps your business in making profits, we will cover everything. By the end, we are sure you will download Quickbooks and start using it. So, without much ado, let’s begin.

It comprises all the tools related to accounting, payroll, inventory, tax filing, bank reconciliation, and much more. Moreover, this software can combine with other software to provide additional functionality. So, if you are looking for software that can help your organization to track all your financial information and create reports, QuickBooks should be your preferred option.

Moreover, QuickBooks offers both desktop version as well as online version which can be easily accessed through a web browser, tablet, or smartphone.

It comprises all the tools related to accounting, payroll, inventory, tax filing, bank reconciliation, and much more. Moreover, this software can combine with other software to provide additional functionality. So, if you are looking for software that can help your organization to track all your financial information and create reports, QuickBooks should be your preferred option.

Moreover, QuickBooks offers both desktop version as well as online version which can be easily accessed through a web browser, tablet, or smartphone.

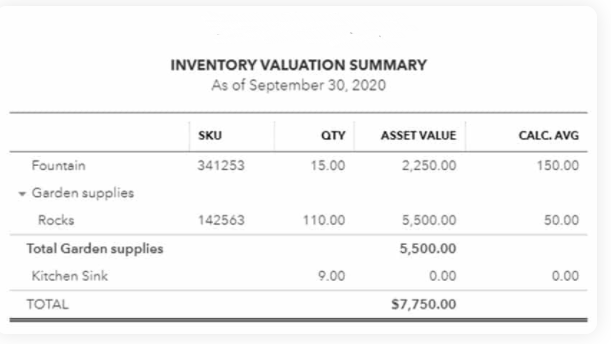

QB can keep track of the amount and cost of your inventory. As you sell inventory, QuickBooks will distribute a portion of it to the cost of goods sold. Nevertheless. this distribution is necessary for computing the taxable income which is extremely time-consuming to perform by hand. Also, QuickBooks may remind you to order inventory when units are low.

QB can keep track of the amount and cost of your inventory. As you sell inventory, QuickBooks will distribute a portion of it to the cost of goods sold. Nevertheless. this distribution is necessary for computing the taxable income which is extremely time-consuming to perform by hand. Also, QuickBooks may remind you to order inventory when units are low.

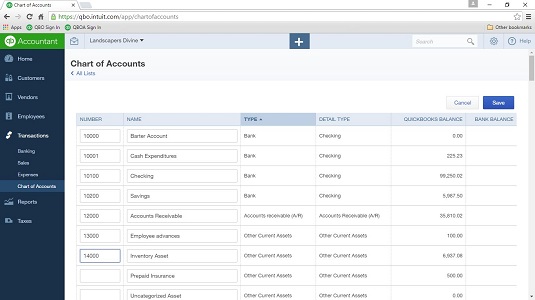

The QuickBooks chart of accounts includes a list of liability, asset, expenditure, income, and equity accounts to which you may allocate your daily transactions. Also, it comprises the company’s financial information. Moreover, the COA includes checking, savings, dividends, account receivables, savings, and balance sheets.

The QuickBooks chart of accounts includes a list of liability, asset, expenditure, income, and equity accounts to which you may allocate your daily transactions. Also, it comprises the company’s financial information. Moreover, the COA includes checking, savings, dividends, account receivables, savings, and balance sheets.

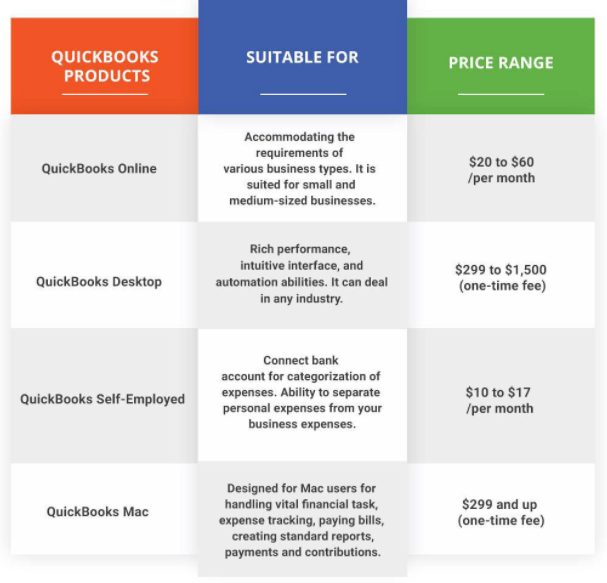

Intuit, the creator of QuickBooks, has developed different variants, which are as follows:

Intuit, the creator of QuickBooks, has developed different variants, which are as follows:

If you are eager to know what is QuickBooks online, then keep reading till the end. QuickBooks Online is accounting software that is available as a cloud-based service. It is designed to meet the demands of various business forms. They are further divided into three additional classes, which you can find below:

If you are eager to know what is QuickBooks online, then keep reading till the end. QuickBooks Online is accounting software that is available as a cloud-based service. It is designed to meet the demands of various business forms. They are further divided into three additional classes, which you can find below:

QuickBooks Desktop is appropriate for those that run a product-based firm with high inventory monitoring requirements. Furthermore, the desktop edition includes custom COA lists, product and service listings, and much more for contractors, manufacturers, distributors, retailers, and others. In addition, the products that come under QuickBooks Desktop are as follows:

QuickBooks Desktop is appropriate for those that run a product-based firm with high inventory monitoring requirements. Furthermore, the desktop edition includes custom COA lists, product and service listings, and much more for contractors, manufacturers, distributors, retailers, and others. In addition, the products that come under QuickBooks Desktop are as follows:

It is an excellent software for real estate agents, freelancers, and Uber or Lyft drivers. Customers using QuickBooks Self Employed may access their work from anywhere, at any time, as long as they have a reliable internet connection. The QB self-employed solution comes in two varieties: Self Employed and Self Employed Tax Bundle.

It has several features, including:

It is an excellent software for real estate agents, freelancers, and Uber or Lyft drivers. Customers using QuickBooks Self Employed may access their work from anywhere, at any time, as long as they have a reliable internet connection. The QB self-employed solution comes in two varieties: Self Employed and Self Employed Tax Bundle.

It has several features, including:

Table of Contents

What is QuickBooks?- A Brief Overview

If you are the one who isn’t aware of “what is intuit QuickBooks?” This brief overview will make you understand the major uses of QuickBooks. QuickBooks, developed and marketed by Intuit, is the most common accounting software used by small business organizations. It comprises all the tools related to accounting, payroll, inventory, tax filing, bank reconciliation, and much more. Moreover, this software can combine with other software to provide additional functionality. So, if you are looking for software that can help your organization to track all your financial information and create reports, QuickBooks should be your preferred option.

Moreover, QuickBooks offers both desktop version as well as online version which can be easily accessed through a web browser, tablet, or smartphone.

It comprises all the tools related to accounting, payroll, inventory, tax filing, bank reconciliation, and much more. Moreover, this software can combine with other software to provide additional functionality. So, if you are looking for software that can help your organization to track all your financial information and create reports, QuickBooks should be your preferred option.

Moreover, QuickBooks offers both desktop version as well as online version which can be easily accessed through a web browser, tablet, or smartphone.

History of QuickBooks

After understanding “what is Quickbooks,” let’s have a look at the history of Quickbooks. In the year 1983, Scott Cook and Tom Proulx led the development of Quickbooks, which was first created in the state of California, USA. Moreover, Quicken’s popularity in the financial management industry has affected Quickbooks to a greater extent. Furthermore, the first edition of Quickbooks was a DOS application based on the software technology of Quicken. After the introduction of the first version of Quickbooks, many accounting experts were unhappy with its service. After that, the management decided to conduct an extensive investigation, which majorly focus on three important causes:- Firstly, no sufficient security control.

- Secondly, Lack of audit trail.

- At last, accounting norms from the past have been pushed to the sidelines.

Read- Complete comparison between Quicken & QuickBooks

Features of QuickBooks Software

After gaining insight into what is QuickBooks and how it all started, it is now crucial to know the type of features this software has to offer when it comes to keeping financial records safe and secure. In comparison, Quickbooks has the greatest functionality of any accounting software, which are as follows:-

Data Migration

-

User Friendly

-

Bank Transactions

-

Simple Process

-

Invoice Generation

-

Tax Calculations

-

Business Projections

What is QuickBooks Used For?

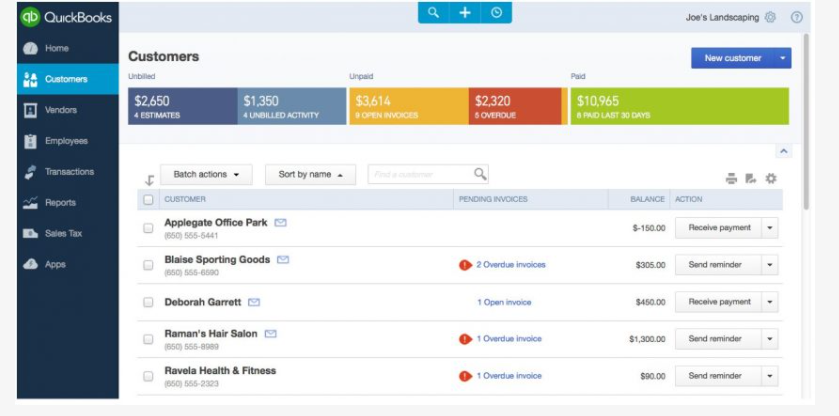

QuickBooks software is mostly used by small organizations to manage invoices and payments and to monitor cash flows. It is also used to prepare monthly and annual financial statements. However, few small businesses try to manage QuickBooks on their own, while others take the help of an external bookkeeper. Thus, to have a look at the uses of QuickBooks software, follow the below-mentioned pointers:1. Generate and Monitor Invoices

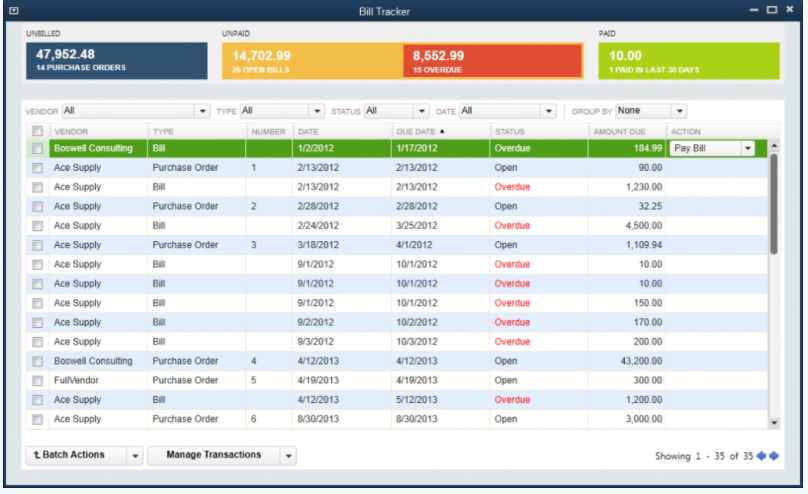

With the help of QuickBooks software, invoices are simple to create and can be printed or sent to customers. It will record your income accurately and will track what each customer owes you. However, running an A/R aging report will show you the number of unpaid bills, and how long they are overdue.2. Maintain a Record of Bills and Expenses

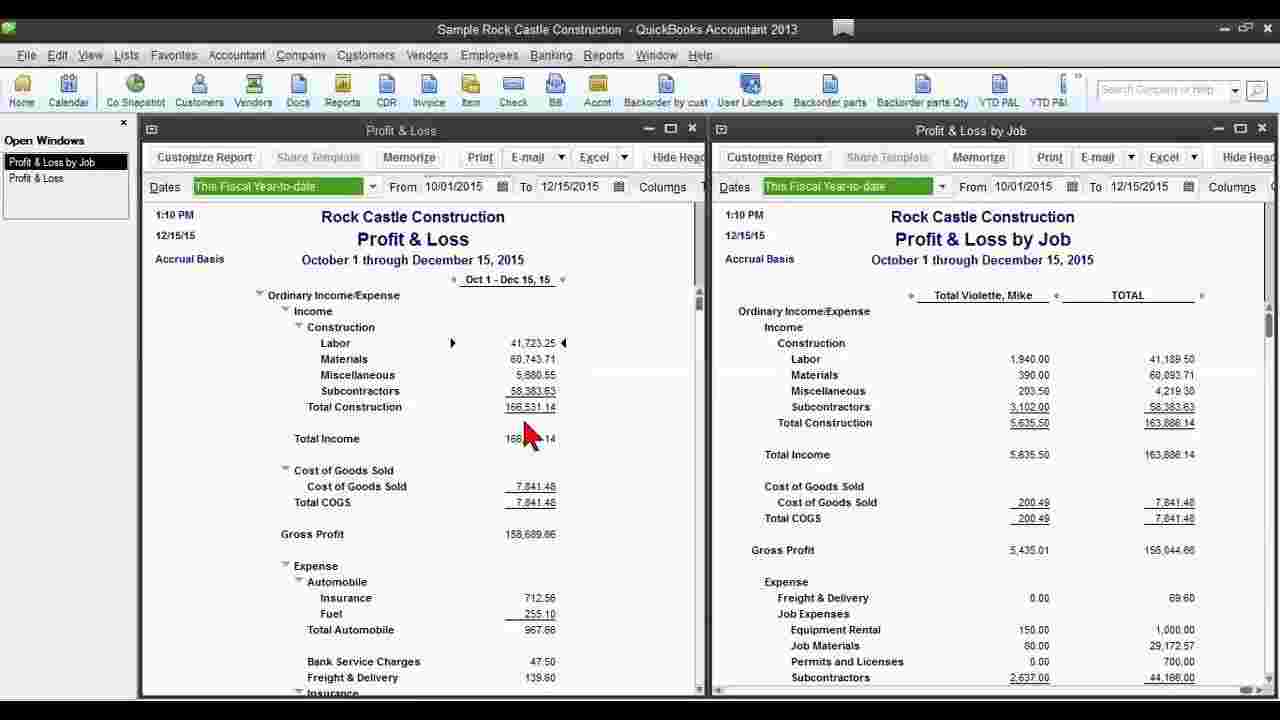

With the help of QuickBooks, you can track invoices and expenses by linking your bank accounts and your credit card, which downloads and categorizes your expenses. If you want to manually track a transaction, you may do it with the help of QuickBooks in a matter of minutes. Also, you may record your bills into QuickBooks as soon as they arrive so that QuickBooks can assist you in keeping track of your future payments.3. Create Financial Statements for Your Company

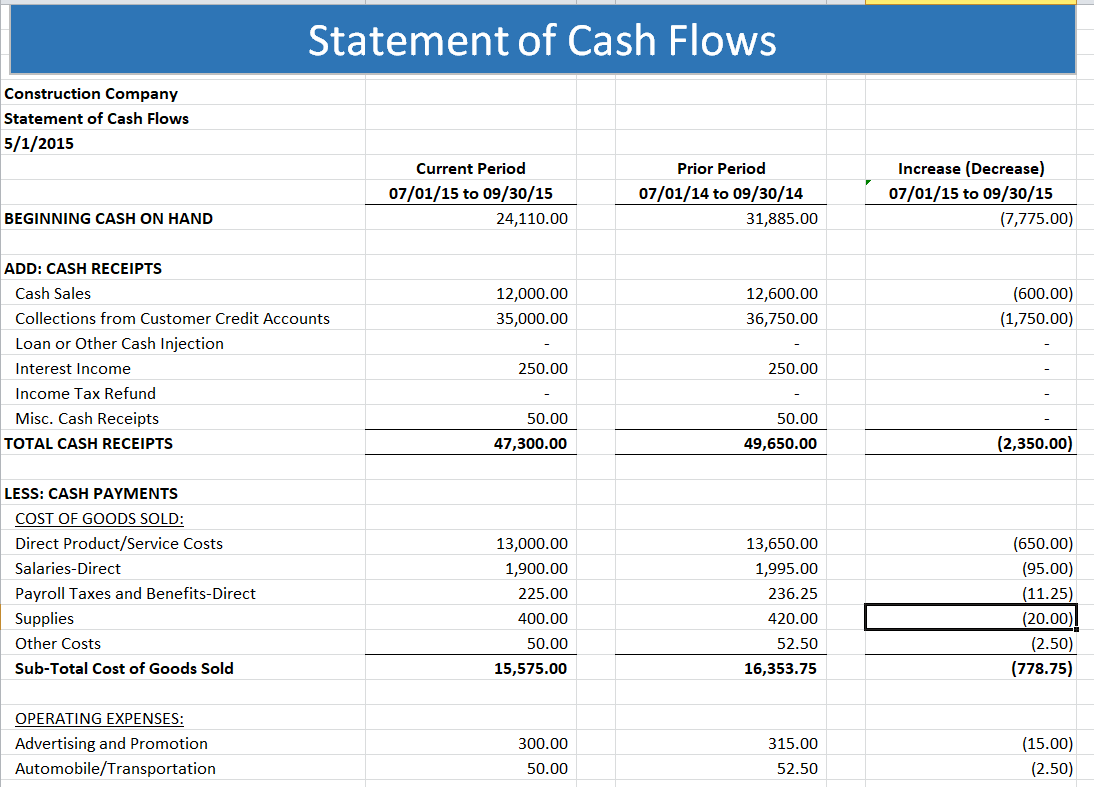

Financial statements can provide important information about the operations of your company. When you apply for a loan, banks or lenders usually ask for financial statements. With a few mouse clicks in Quickbooks, you may even generate the following three major financial statements:- The P&L report shows how profitable your company is. You may calculate it by adding your revenue and subtracting your costs.

- The balance sheet comprises of assets, liabilities, and equity of a company at a specific point in time.

- Statement of Cash Flows focuses more on all of the business operations, both cash inflows and cash outflows of the organization.

4. Maintain Employee Hours and Payroll

You don’t want to compromise on payroll by performing it manually. Payroll mistakes may result in penalties and dissatisfied workers. QuickBooks offers a payroll tool that can calculate and process payroll automatically. Moreover, it keeps track of the working hours of your workers. The hours monitored are later applied to your client bills as well as your payroll. Furthermore, the good part about utilizing QuickBooks payroll is that it is fully connected with QuickBooks and your financial statements are always up to date. Additionally, to manage payroll you must have a QB payroll subscription. When you run your payroll with QuickBooks, you will be able to:- Pay your payroll taxes with QuickBooks.

- Employees might be paid by cheque or through direct deposit.

- Automate the calculation of federal and state payroll taxes.

- Allow QuickBooks to fill out the payroll tax forms on behalf of you.

5. Maintain Inventory

QB can keep track of the amount and cost of your inventory. As you sell inventory, QuickBooks will distribute a portion of it to the cost of goods sold. Nevertheless. this distribution is necessary for computing the taxable income which is extremely time-consuming to perform by hand. Also, QuickBooks may remind you to order inventory when units are low.

QB can keep track of the amount and cost of your inventory. As you sell inventory, QuickBooks will distribute a portion of it to the cost of goods sold. Nevertheless. this distribution is necessary for computing the taxable income which is extremely time-consuming to perform by hand. Also, QuickBooks may remind you to order inventory when units are low.

6. Ease on Taxes

The most essential aspect QuickBooks can do for your small business is to make tax time easier. Compiling your income and spending is the most difficult aspect of completing a tax return. If you are a regular user of QuickBooks, all you have to do at tax time is print your financial statements. Moreover, with QuickBooks Online, you can ask your tax preparer to log in to your account directly so they can check your figures and print any information they need to complete your return.7. Take Online Payments

Providing consumers the opportunity to pay their bills online is one of the best methods to boost your cash flow. QuickBooks Payments may be added so that consumers can pay online immediately. QuickBooks Payments works in the same way as other merchant services. As it is linked with QuickBooks, the sale, credit card fee and a cash deposit are all immediately recorded.8. Able to Scan your Receipts

Another important factor in making tax season go as smooth as possible is the ability to arrange your receipts in QuickBooks. Every customer of QuickBooks may download the QuickBooks app for free on their mobile device, take a photo of a receipt, and upload it to QuickBooks Online in a matter of minutes. However, QuickBooks allows you to attach a receipt to a banking transaction. You may upload an infinite amount of receipts to QuickBooks Online; the receipts, along with your data, are saved in the cloud. This might be beneficial for businesses that track a large number of costs.How does QuickBooks Work?

After having a look at what is QuickBooks; it’s time to understand how QuickBooks work.-

QuickBooks COA

The QuickBooks chart of accounts includes a list of liability, asset, expenditure, income, and equity accounts to which you may allocate your daily transactions. Also, it comprises the company’s financial information. Moreover, the COA includes checking, savings, dividends, account receivables, savings, and balance sheets.

The QuickBooks chart of accounts includes a list of liability, asset, expenditure, income, and equity accounts to which you may allocate your daily transactions. Also, it comprises the company’s financial information. Moreover, the COA includes checking, savings, dividends, account receivables, savings, and balance sheets.

-

Customer, Vendor, and Item Lists

-

Reports

-

Payroll

-

Billing and Invoices

QuickBooks Variants

Intuit, the creator of QuickBooks, has developed different variants, which are as follows:

Intuit, the creator of QuickBooks, has developed different variants, which are as follows:

- QuickBooks Online

- QB Desktop

- QuickBooks Self-Employed

- QB Mac

- QuickBooks Apps

Also Read: FreshBooks vs QuickBooks – Detailed Comparison (Best of 2022)Let’s discuss these variants, one by one.

1. QuickBooks Online

If you are eager to know what is QuickBooks online, then keep reading till the end. QuickBooks Online is accounting software that is available as a cloud-based service. It is designed to meet the demands of various business forms. They are further divided into three additional classes, which you can find below:

If you are eager to know what is QuickBooks online, then keep reading till the end. QuickBooks Online is accounting software that is available as a cloud-based service. It is designed to meet the demands of various business forms. They are further divided into three additional classes, which you can find below:

-

Simple Start

-

Essential Version

-

Plus Version

2. QuickBooks Desktop

QuickBooks Desktop is appropriate for those that run a product-based firm with high inventory monitoring requirements. Furthermore, the desktop edition includes custom COA lists, product and service listings, and much more for contractors, manufacturers, distributors, retailers, and others. In addition, the products that come under QuickBooks Desktop are as follows:

QuickBooks Desktop is appropriate for those that run a product-based firm with high inventory monitoring requirements. Furthermore, the desktop edition includes custom COA lists, product and service listings, and much more for contractors, manufacturers, distributors, retailers, and others. In addition, the products that come under QuickBooks Desktop are as follows:

- Pro Version

- Premier

- Enterprise

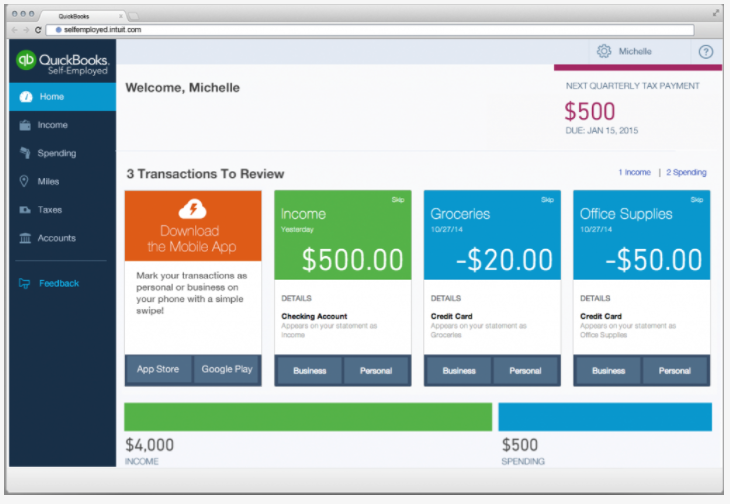

3. QuickBooks Self-Employed

It is an excellent software for real estate agents, freelancers, and Uber or Lyft drivers. Customers using QuickBooks Self Employed may access their work from anywhere, at any time, as long as they have a reliable internet connection. The QB self-employed solution comes in two varieties: Self Employed and Self Employed Tax Bundle.

It has several features, including:

It is an excellent software for real estate agents, freelancers, and Uber or Lyft drivers. Customers using QuickBooks Self Employed may access their work from anywhere, at any time, as long as they have a reliable internet connection. The QB self-employed solution comes in two varieties: Self Employed and Self Employed Tax Bundle.

It has several features, including:

- First, you may link your bank accounts and credit cards.

- QuickBooks Self-Employed makes it simple to keep track of your business’s income and spending.

- It will record the quarterly taxes on your behalf.

4. QuickBooks Mac

QuickBooks for Mac is Intuit’s financial software for Mac users. If your system is Mac-compatible, you must use the QuickBooks Mac version. This edition is similar to QuickBooks Pro, and it is appropriate for the majority of small businesses that do not manufacture products. Moreover, it has several features, including:- First, Unpaid invoices will appear on your Income Tracker dashboard.

- Secondly, it allows you to create fiscal year budgets and track your success.

- If you don’t have accounting or bookkeeping experience, setting up and navigating the accounting software might be a difficult undertaking.