QuickBooks Self Employed was designed to serve individuals such as Freelancers, Uber Drivers, Real Estate Agents, and several independent consultants. It lets you track your mileage, income, expenses, etc., and helps automate your accounting process.

Having such features, users often inquire if it’s suitable for them, how much it cost, its advantages and drawbacks, etc. In this regard, we have reviewed QuickBooks Self Employed and explained all the information regarding it. So, let’s begin.

Table of Contents

Is QuickBooks Self Employed ideal for you?

While reviewing QuickBooks Self-Employed, we discovered that the benefits and services it offers are suitable according to conditions. Let’s find out:

QuickBooks Self Employed is ideal for:

- Freelancers: QuickBooks Self-Employed offers useful features to freelancers like quarterly tax estimation, automatic mileage tracking, and mobile invoices. In addition, the dashboard feels easy to navigate.

- Remotely-Working Businesses: Creating invoices, automatically tracking business mileage, and tracking the profit and loss anywhere helps remotely-working businesses achieve their goals.

QuickBooks Self-Employed is not ideal for:

- Entrepreneurs with more than one company: QuickBooks Self-Employed is not built to serve multiple companies. So, we recommend Turbotax, which we consider ideal for multi-company accounting software.

- Growing businesses: Since the self-employed edition of QuickBooks is a single-entry accounting solution, it is not ideal for businesses that are growing. For such purposes, we recommend QuickBooks other versions.

- Frequent invoicing: QuickBooks Self-Employed won’t save the customer, service, or product data, which means you must add the details of the buyer and the recipient each time you create an invoice.

How QuickBooks Self Employed works?

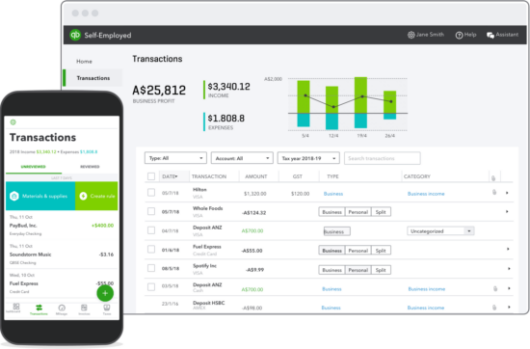

QuickBooks Self-Employed works by connecting all your accounts (checking, PayPal, Credit Cards, etc.) and allows you to track your income as well as expenses in one place.

It is necessary to spend some time to organize your transactions, however, at a minimum, at the beginning. You can accomplish this by manually classifying the expenses and income as personal or business, or developing rules to automatize the process.

In addition to tracking and categorizing additional expenses, you can also track the mileage and calculate deductions for it.

It is also possible to create, track and send invoices, though it only allows a few customizations and doesn’t allow estimates, it can produce the following reports for business:

- Mileage Log.

- Receipts.

- Tax Details.

- Summary of Tax.

- Profit and Loss.

QuickBooks Self-Employed: Pricing & Features

The pricing of QB Self-Employed comes with three pricing plans, and they range from $15 to $35 monthly. If you want to include tax returns and live assistance from an agent, lawyer, or certified public accountant (CPA), the prices vary.

After reviewing its pricing, we’ve prepared a table that’ll help you understand its features as per the price. See below:

| Pricing & Features | Self Employed | Self Employed Tax Bundle | Self Employed Live Tax Bundle |

| Pricing | $15 | $25 | $35 |

| Track Mileage | ✔ | ✔ | ✔ |

| Create Customer Invoices | ✔ | ✔ | ✔ |

| Separate Personal & Business Expenses | ✔ | ✔ | ✔ |

| Automatic Quarterly Taxes Calculation | ✔ | ✔ | ✔ |

| Bank & Credit Card Connect to Import Transactions | ✔ | ✔ | ✔ |

| Federal & State Tax Return Filing | N/A | ✔ | ✔ |

| Pay Quarterly Estimated Taxes Directly Via QuickBooks | N/A | ✔ | ✔ |

| TurboTax Tax Experts Reviews Your Final Return | N/A | N/A | ✔ |

| Unlimited Live Help Via TurboTax Tax Experts | N/A | N/A | ✔ |

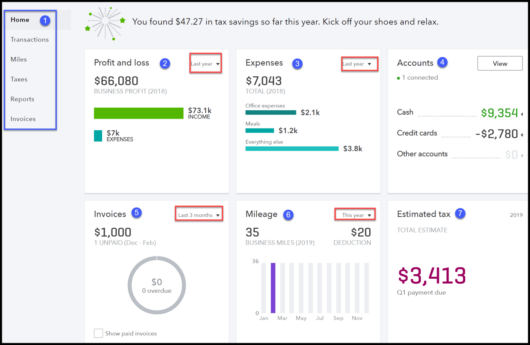

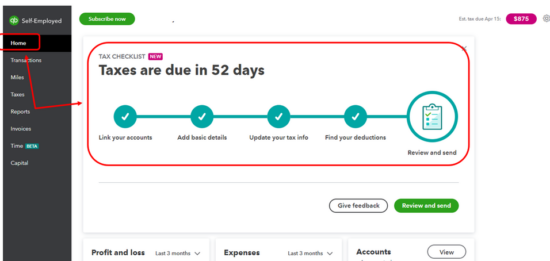

The interface of QuickBooks Self Employed

QuickBooks Self-Employed comes with a variety of tools to help you keep track of your earnings and expenses. This includes the ability to monitor your mileage, link your credit and bank accounts, segregate personal and business expenses, download receipts as well as create Profit and Loss (P&L) statements.

Although QuickBooks Self-Employed does have a P&L account, it does not include a balance sheet nor monitors liabilities and assets. Its dashboard provides an insight into profits and losses, invoices, accounts as well as estimated tax. Let’s explore its dashboard.

- Left Menu Bar: It allows you to navigate to every part of the program.

- Profit and loss: Review total income with expenses for any period like last month, this year, etc.

- Expenses: Review your total expenses over the specified period of time.

- Accounts: Check the current balance of all credit card and banking accounts.

- Invoices: View invoices that are owed to you by customers.

- Mileage: Keep track of total mileage using the mileage tracker app by QuickBooks.

- Estimated taxes: Examine the estimated tax you owe by an automatic calculation performed by self-employed QuickBooks.

Beneficial Features of QuickBooks Self-Employed

The QuickBooks Self-Employed offers numerous features to its user. While reviewing it, the below-mentioned features attracted us the most.

1: Mileage Tracking

The mileage tracker of QuickBooks Self-Employed can be downloaded on your iOS and Android. It will automatically monitor all of your car travel and record your business miles with deductions based on IRS mileage rates.

2: Invoicing

The invoicing section lets you generate and monitor invoices easily. However, if you choose to sign up for making an invoice payable online, remember that the bank transactions charge nothing but the rate for credit card payments is 2.9%.

3: Bank Feeds

This feature lets you download the credit card and banking transactions straight into the QuickBooks Self-Employed account. Then, you can keep the transactions to an appropriate category or as a personal expense.

4: Receipt Capture

The QB Self-Employed mobile application for Android and iPhone makes receipt capture easy. Just take a snap of any receipt and you can attach it directly through your phone.

5: Customer Service and Integration

The all-new design of the QB self-employed dashboard is simple to use and offers a lot of shortcuts. Furthermore, the customer service has also improved. You get support options such as troubleshooting video tutorials, live chat, Learn & Support, QuickBooks blogs, an automated assistant, and an active community forum.

Tax-Related Features of QuickBooks Self-Employed

1: Summary printing of Income and Expenses

Now classify your income and expenses with categories to comply with IRS Schedule C, like legal fees, utilities, and commissions. After you enter this information, print a summary of your income and expenses to ease up your tax filing.

2: Quarterly calculation of Federal Tax

While setting the tax profile, QuickBooks Self-Employed will automatically calculate your annual profit and estimated tax payment for you. Furthermore, you’ll get an alert on tax due dates. This protects you from penalties and saves your money.

3: Importing Schedule to TurboTax

If you purchase the tax bundle of QuickBooks Self-Employed, you’ll get a subscription for TurboTax. Furthermore, you get to transfer all the Schedule C information to TurboTax with ease. This feature is beneficial to those who do their own taxes.

4: State & Federal Tax Filing

The Tax Bundle also includes state and federal tax returns for just $120 per annum ($10 extra per month). If Purchased separately, the TurboTax Self-Employed costs $120 without the state return. If you do taxes then you’ll appreciate this.

QuickBooks Self-Employed: Pros & Cons

As we reviewed QuickBooks self-employed, we discovered its advantages as well as some drawbacks. The attached table will help.

| PROS | CONS |

| Track Personal and Business expenses together. | It’s impossible to track unpaid bills. |

| Calculate estimated taxes for the quarter. | Limited functionality for invoicing |

| Track expenses and mileage from anywhere. | It doesn’t have a balance sheet |

| You can transfer Schedule C to TurboTax. | There is no payroll integration |

If you’re self-employed or a freelancer with no contractors or employees, QuickBooks Self-Employed will be ideal for you. It will help you track your deductions and utilize the information to fill out taxes to get benefits on Tax returns.

In addition, instead of looking for receipts or possibilities for tax deductions, you can use your deduction information and thus eliminate the confusion.

Furthermore, the Tax bundle plan lets you file Local as well as State tax returns and help you estimate tax payments for the quarter. With all factors discussed here, now it’s your call to use or not use QuickBooks Self Employed.