The QuickBooks General Ledger report shows transactions for a particular date range. It displays transactions from all accounts, like equity, cash, accounts receivable, and undeposited funds. The QuickBooks general ledger allows users to prepare, calculate income, and financial expenses, and maintain the accounts up to date every time. Moreover, the data also gets synced with the user’s device that enhancing the accounting experience even more.

We get a lot of questions about how to find and print a ledger report. That is what inspired us to write a detailed article about the General Ledger QuickBooks for you. Here, you will learn how to “find and print general ledger reports in QuickBooks” and how you can create journal entries easily for General Ledger. Let’s understand what exactly is QuickBooks General Ledger in Detail.

Table of Contents

QuickBooks General Ledger: All Explained

General Ledger QuickBooks Report shows how a company manages and controls its money flow. This report displays a list of transactions for a particular date range across all accounts. A few examples of general ledger accounts are cash, equity, accounts receivable, and undeposited funds. QuickBooks utilizes the double-entry system of bookkeeping, which needs you to record an offset credit for each debit in your account. These transactions can also be recorded using journal entries. Accounting professionals who don’t follow traditional accounting norms also create a general journal. This report must be maintained and backed in case any transactional or accounting errors show up.

Note: For this purpose, users can use “Transaction Details” from “Account Report”.

Basic Terminologies of QuickBooks General Ledger

When accountants keep manual records, we obtain different journals for each activity. However, The three main journals are as follows:

- Accounts Receivables: The daily records of the sales and receipts of the company and the bills that have not been paid by the customers yet.

- Accounts Payable: These are the daily records of the purchases that the company made and any bills that have to be paid by the company.

- Payroll: It is a record of the wages of each employee and the Cheque written to pay them.

Enter the summary of monthly operations in the general ledger, “the Books,” as it is the master record of any organization. However, to make journal entries, make use of double-entry systems. If all of the information is entered correctly, the company’s books will stand balanced. This implies that if you sum up all of the balances in each account, your total would be zero.

Moreover, there is a procedure for enabling QuickBooks general ledger functionality. It employs double-entry accounting to generate financial statements. To make it work effectively, it needs to have both credit and debit balances along with some amount of dollars.

Also, double-entry accounting maintains the accounting balance and requires you to follow the balance sheet formula to calculate the balance.

Also Read: Download & Use QuickBooks Connection Diagnostic Tool

How Does The QuickBooks General Ledger Report Work?

QuickBooks general ledger follows a specific process to turn on its functions for the users. It follows the double-entry accounting method to generate financial statements. This needs debits, credit cards, and dollar amount to work out.

It has some criteria to function with the cards, and amounts like;

- The dollar amount of credits and debits must be the same.

- The used number of debits, and credits account, should not be equal.

- At least one debit and credit entry are allowed for each journal entry.

The double-entry method keeps the accounting balance. And it follows the balance sheet formula to keep it in balance. The addition of liabilities, and owner’s balance equity shows the business assets.

Always remember that you are following the below procedure for the balance sheet:

Liabilities + Owner’s equity = Assets

Types of General Ledger Accounts

Typically, there are 6 types of General Ledger Accounts. These are listed below:

Accounts of Assets

Assets are simply the resources that your company has. The asset account has the following things.

- Cash

- Debtors

- Accounts Receivable

- Inventory

- Land and Structure

- Machinery and Plant

Account for Liabilities

The liabilities mean the sums owed to persons or third parties. Some liabilities examples are:

- Creditors

- Exceptional Expenses

- Accounts Receivable

- Long-Term Credit

Shareholders Equity

The shareholder’s equity is basically the excess of the asset over liabilities in a company. Some stockholder’s examples are:

- Common Stalk

- Treasury

- Retained Earnings

Accounts of Operating Income

Income earned by your main business activities is operating income. It includes:

- Fees

- Sales

Accounts for Operating Expenses

These are the expenses that are important to incur to run your company on an everyday basis. These include:

- Rent

- Salaries

Accounts for Non-Operating Income

Non-Operating Costs and revenues are one-time expenses or incomes that you earn. Non-operating costs and income include:

- Gain on Asset Sale

- Assets Sold at a Loss

- Interest Charge

- Income from Dividends

- Interest Earnings

How do I make General Ledger entries in QuickBooks?

Follow the steps to create entries for the general ledger report QuickBooks of undeposited funds.

- Firstly, Open QuickBooks.

- Navigate to “Menu”.

- Now tap on “Company” and choose the option “Make General Journal Entries”.

- Pick the Date field to select the correct date for the QuickBooks ledger entry.

- Select the Entry Number file then input a value there. After this, all the following general ledger entries will be automatically numbered.

- Thereafter, select the “Account” and choose the account that you will be using for your debit.

- Now mention the debit value of your transition under the “Debit Column”.

- If you wish to add a message with the entry, simply click on the “Memo” box.

- Complete the remaining information by entering the vendor, customer, and name for your transactional record.

- Use the credit the same way to indicate a deposit or to enter a new transaction. To even out the balance sheet transaction, it is important that you use the same information and amount as in the debit column.

- Finally, tap on Save & Close when the transaction register reaches zero. If it still does not show zero, then check all details again and click Save & Close.

Important Note: Users can use the feature “Journal Entry” to track miscellaneous transactions that don’t belong in the transaction register.

How do I Run Quickbooks General Ledger?

Follow the steps below to create a QuickBooks general ledger report.

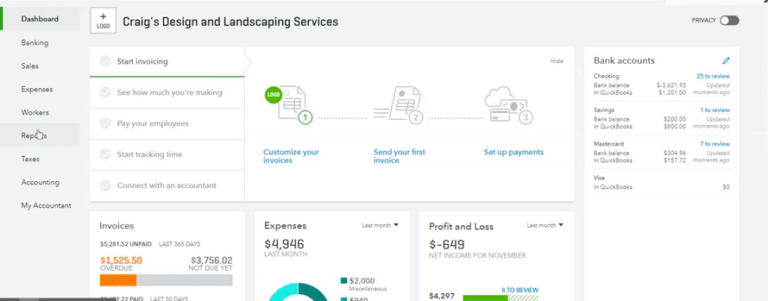

- Firstly, open QuickBooks.

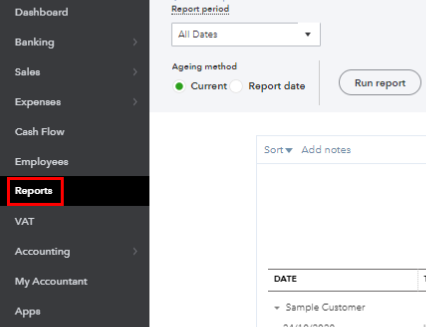

- Tap on “Reports”

- Go to the bottom of your screen and choose the option “All”.

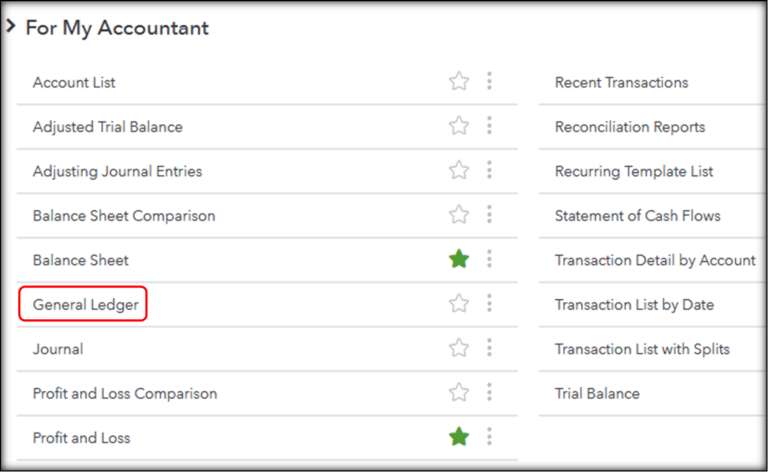

- There, you will see the option “My Accountant”. Just tap on it.

- Choose the 6th option which is “General Ledger”.

- Select the date of your transaction range and select between Accrual or Cash basis.

- Finally, tap on the option “Run Report” to generate it.

How do I Create a New Account for QBO General Ledger Entry?

These steps will help you create a new general account.

- Firstly, open QuickBooks Online.

- Now click on “Accounting”.

- Then tap on “Chart of Accounts”.

- Thereafter select “New”.

- Select an account by clicking on the drop-down menu “Account Type”.

- In a similar process, select a “Detail Type” and then provide the Beginning Balance.

- Finally, tap on Save & Close.

How do I Print General Ledger in QuickBooks?

These steps will guide you on how to print a report of the QuickBooks general ledger.

- Firstly, open QuickBooks.

- Then select “Print Reports“.

- Thereafter, tap on “Transaction Reports” and choose the “General Ledger” option.

- Here, enter the month as well as the year and leave the rest of the field empty.

- Finally, preview it and tap on “Print”.

We hope this post has helped you understand everything about QuickBooks General Ledger. It’s pretty clear how important it is for all accountants and businesses. If this post interests you then you can visit our website to access more related articles Payroll Updates Tax Table, Bank Feed Issues, & more. They are surely worth your time!