An opening balance equity QuickBooks’s account is often created automatically rather than manually. Many consumers get perplexed when they discover a balance for an account they have no recollection of opening.

Some people disregard it, which is a mistake because it is just intended to be a temporary account. Not closing out this account makes your balance sheet seem unprofessional, and it may also indicate that you have an inaccurate journal entry in your books.

Table of Contents

QuickBooks Opening Balance Equity: Meaning

While calculating account balances into the QB accounting software, the offsetting entry used is known as the opening balance equity. The necessity to set up this account arises when previous account balances are being set up in QuickBooks. It serves the purpose of an offset to the other accounts, ensuring that the books are always balanced.

After completing the process of account entry for all the accounts, compare the overall opening balance equity to the sum of all opening equity accounts recorded in the previous account balances. In case the balance matches it is presumed that the starting accounting entry was correct. In case it is not, go back and look for the original account balance entry to check if there was any data entry issue.

Once you have recorded all the opening account balances, the balance in the initial balance equity account is transferred to the other equity accounts, particularly common stock and retained earnings.

Identify QuickBooks Opening Balance Equity Accounts

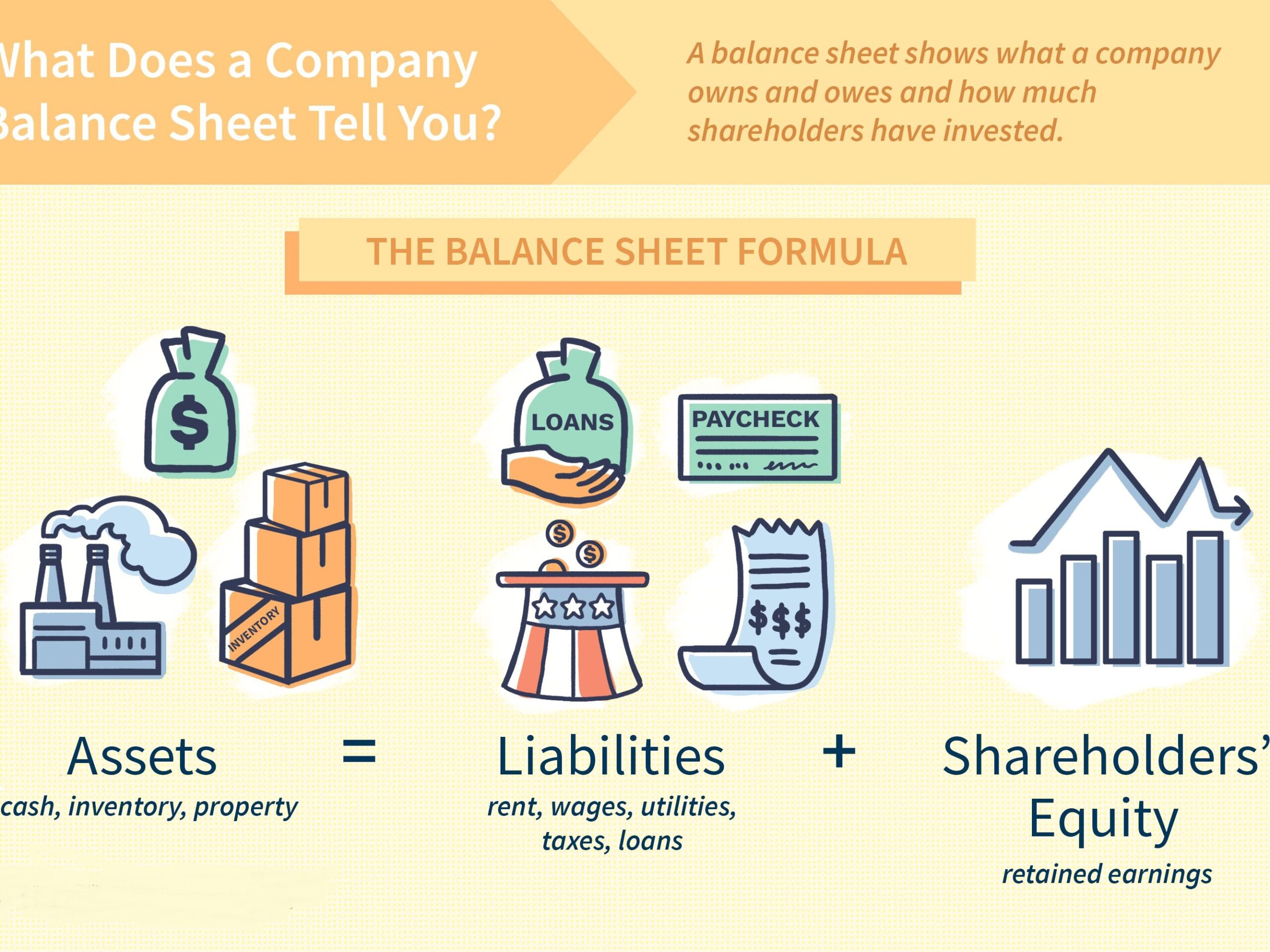

To better understand the balance equity accounts, it’s crucial to understand the balance sheet.

The balance sheet comprises of three categories, namely:

- Assets

- Liabilities

- Equity

Thus, The basic balance sheet equation is:

Assets= Liabilities + Equity

Balance-sheet transactions must always cancel out at zero. As a result, if you create a new asset account with a balance, you must normally offset it by the same amount on the other side of the equation.

Just assume an asset account, such as a checking account, with a balance of $100 is still added to accounting software. In order for your balance sheet to remain balanced, another account must get affected by $100.

How to Set the QuickBooks Opening Balance Equity Account

You must set up the QuickBooks opening balance equity account in the same way as you would a credit card or a bank account. To input opening balance equity in QuickBooks, follow the steps outlined below.

- To begin, navigate to the Company menu and pick Chart of Accounts.

- Then, with the Chart of Accounts selected, right-click anywhere.

- After that, click on New

- You must pick either a credit card or a bank account as your account type

- Now, at the Add New Account page, follow these steps:

- Fill up the blanks with relevant details.

- Hit Start with Opening Balance Catch.

- Even after the account has been set up and if no transactions record exists, the Enter opening balance button will be present.

- After you input transactions, you will see “Adjust Opening Balance” instead of entering the opening balance.

- Before entering the QB Start date from the latest received statement, enter the ending date as well as the ending balance.

- Then, click the OK button.

- Finally, select the Save and Close option.

Reasons for QuickBooks Opening a Balance Equity Account

For numerous reasons, the software generates a QuickBooks opening balance equity account, including:

- Creating a data file with starting balances for new enterprises

- The first bank and credit card accounts with balances were added.

- First time using a new accounting program

- Adding a new item, such as fresh inventory, to the chart of accounts

- Entry of a new vendor or customer with value balances (for example, outstanding balances which results in an accounts receivable opening balance)

Follow these steps after entering your Opening Balances

- Take the final balance from your most recent bank statement.

- Any outstanding controls have the ability to raise an amount.

- If there are any outstanding deposits, they shall deduct from the total.

- You must now create a journal entry by crediting the opening balance equity and debiting the credit card or bank account.

- Select Render General Journal Entries from the business menu.

- Set the date as well as the entry number in the journal.

- Choose a bank or credit card account from the account and debit columns.

- In addition, enter the amount estimated in Step 2.

- Choose an account from the drop-down menu.

- Then, pick the option for opening balance equity.

- Enter the amount computed in Step 2 into the credit column once again.

- By making checks or deposits, enter the pending transactions using the opening balance equity as the revenue or cost account.

- Reconciliation was provided for these transactions without altering the preceding period’s balance sheet.

- Using the mini reconciliation method, reconcile the opening balance journal entry for each account.

Common Mistakes to Avoid

The opening balance equity QuickBooks should only be used for a short period of time. However, it is usual to carry a balance for an extended length of time.

Bank reconciliation adjustments that were not completed properly, leaving an initial balance, are a typical cause of a lingering balance on your opening balance equity account. When doing bank reconciliation, be certain that the bank statement balance transaction accounts for unpaid bank checks and other issues.

If the amount of the journal accounting entry does not match the amount on your bank statement, and you close it out, the program will change the QuickBooks opening balance equity account balance.

Other explanations are as follows:

- It’s horrible not knowing it’s bad.

- A transaction is wrongly attributed to the opening balance equity account.

- The opening balance equity account has still not been deleted.

Bringing an Equity Account’s Opening Balance to Zero

Clear the balance in this account to make your balance sheet seem more professional and tidy.

You or your bookkeeper can shut this account in a variety of ways by making journal entries. The most common way is as follows:

- Change the balance equity to “Retained Earnings” if your company is a corporation.

- If your business is a sole proprietorship: Close the equity balance to “Owner’s Equity.”

If the balance is positive, make a debit entry to the opening balance equity account and a credit entry to the owner’s equity account (or retained earnings account.)

In case the balance is negative, credit the opening balance equity account and debit the owner’s equity account (or retained earnings account.)

Also Read: QuickBooks Memorized Transactions: Learn to Create, Edit & Delete (Quick Guide)

Managing QuickBooks Opening Balance Equity to Produce Presentable Balance Sheets

Opening balance equity should be employed only for a limited period of time. The appearance of a balance on your initial balance equity account seems unprofessional on your balance sheet.

Transferring opening balance equity accounts to retained profits or owner’s equity accounts is preferable.

Clearing Opening Balance Equity in QuickBooks

The following are the methods to terminate the opening balance equity in QB Online; be sure to follow them in the same order:

- Firstly, In QuickBooks Online, go to the Settings tab and click the Gear icon.

- Now, access the Chart of Accounts, pick the appropriate accounts, and click View Register

- Also, in the drop-down arrow on the filter icon, enter opening balance.

- Then. Click the Apply button.

- Following that, the opening Equity Balance will subsequently be displayed on the screen. You must select the Edit option in the right bottom corner.

- You must then click the More button at the bottom of the deposit transaction screen, followed by the Delete button.

- Finally, tap Yes.

We believe this guide will be helpful in gaining insight on QuickBooks opening balance equity. However, if you face any issues, you may connect with the technical team for further assistance.