It’s critical to understand the QuickBooks Payroll Updates if you’re a QBs Payroll user. If you have a newer version of QBs & tax table in your account that displays any difficulties, you must update the table of payroll tax to the most recent release.

However, if you are also looking for the best method for verifying, downloading & installing tables of QBs payroll tax, your search is over! Check this section to initiate the procedure of downloading, and proving tables of QBs payroll tax.

We’ve covered all you need to know about obtaining and installing the most recent table of payroll tax updates in this post. For more details, read the entire article till the conclusion. The updates will be immediately installed if you have a QuickBooks Online Payroll membership.

Table of Contents

Understanding QuickBooks Payroll Updates Tax Tables

It is important to know what the process involves before getting into the specifics of the downloading steps and installing and then unique QuickBooks Payroll Updates. In addition to, the table of tax inferences for payroll is a graph with multiple cues that help in determining the correct taxes that should be taken out of the worker’s salary.

Moreover, it is important to note that tax rates are affected by a range of conditions such as your income earned, the worker’s married status, & the tax timetable, which could be bi-weekly or month-wise, etc.

Essential Points to Consider

The user must keep certain things in mind when downloading, installing, & confirming the table of QB Payroll Tax, such as:

- If you want to update tax table, you’ll have an operational payroll subscription.

- Also, make sure you have the most recent QB release.

- To update the table of payroll tax, you’ll need internet access.

- Finally, in case the user wants to get the table of payroll tax updates directly as they are released, they need to enable the computerized upgrades to function in QBs Desktop.

Steps to Download and Install Tax table in QuickBooks

Without a doubt, it stands essential for you to install or download the latest table of QB Payroll tax upgrades to be certain that Payroll fills with accurate information.

If you’re an end-user of QuickBooks payroll updates, all that you need be doing is take a handful of basic steps to begin.

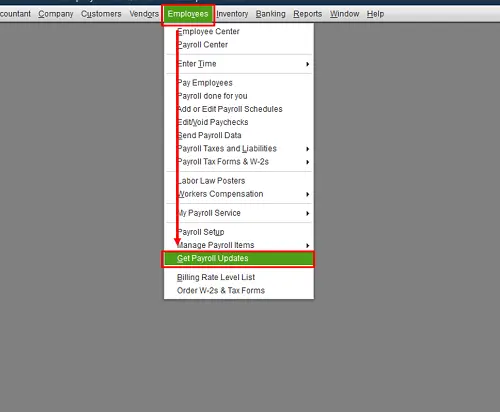

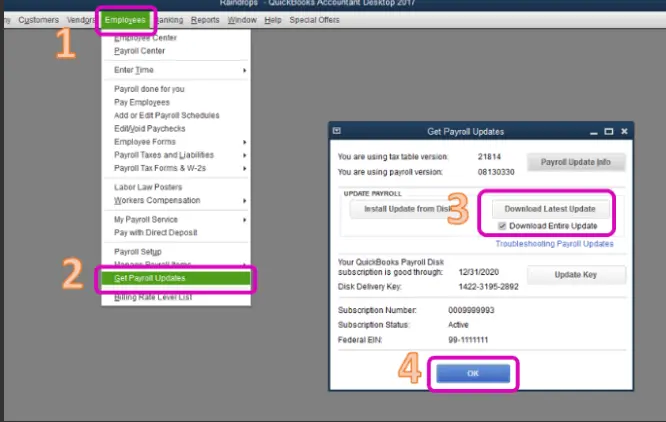

- To start, go to the employee’s section of the menu.

- After that, select the option to reach payroll updates.

- Then, in the checkbox to get the whole update.

- Now, choose the option to get the most recent update.

- Finally, after the completion of downloading, you will finally see a window emerge.

Install QuickBooks Tax Table

- To start, you must first put Payroll Update CD.

- Thereafter, choose “Get Payroll Updates” choice.

- Pro & Premier editions of QuickBooks Desktop: The You have to first choose the Employees alternative, followed by receive payroll updates choice.

- Then, if the buyer gets the instructions to identify the data file or update.dat in the window of Install Payroll Update, they must perform the appropriate measures and react to the instructions moving ahead.

- After that, on the QB service sign-up screen, select the add option.

- Then, choose the next option after entering the service option.

- To end with, Enter the option of desk delivery & then press the next button.

A notification will appear on the display once you’ve installed the updated tax table:

- The update of the payroll CD must be inserted into the drive CD at this stage.

- Go to the menu for employees.

- Select the option to get payroll updates.

- Install the update from the disk is the option.

- The final action is to choose install.

Ways to Check QuickBooks Tax Tables

- In the window of Install Confirmation, verify that you are installing the correct location & that the versions of tax table in the New & Current fields are right.

- Click next after the completion of upgrading or a pop-up like “A new table has been installed on your desktop”.

- Select OK.

- In case version of tax table has been revised, a message seems as “You have successfully installed payroll update.”

Latest Features in QuickBooks Payroll Updates 22011

Let’s talk about the latest payroll update 22011 and its new features.

- The Family First Coronavirus Response Act specifies a new tax tracking type to track employer liabilities for paid credit leaves, which is covered by this tax table (FFCRA).

- Forms Update: There have been no form updates in this payroll update.

- e-File and Pay Modifications: There are no e-File or Pay changes in this payroll update.

- If you don’t want to use Auto-Update, you may finish the installation procedure by closing and reopening QuickBooks after downloading the tax updates.

Few of the Reasons Why Payroll Tax Table is Outdated?

You may experience this sort of error as a result of:

- The latest table of payroll tax editions is not installed in QuickBooks Software.

- In a multi-network setting, QuickBooks is mostly utilized.

- Some QuickBooks software on the same network hasn’t been upgraded to include the most recent tax table edition.

Methods to Resolve QuickBooks Payroll Update Errors

After the installation of the current table of QBs Payroll Tax Updates, the TD1 amount frequently fails to update and this may cause payroll update issues. In that situation, you’ll need to run the following checks:

- In case the TD1 stakes remain unchanged after downloading the most recent update of tax table, you must undertake the necessary checks:

- ‘Check effective date of tax table’, whether it is after the date or on a date, is requested for you.

- The user must either begin with payroll. You have to apply and exit QBs Desktop for TD1 amounts to be up to date after downloading the product update that includes the updated tax tables.

- The table of new tax wouldn’t override any already modified amounts if the user had ever directly altered TD1 amounts for an employee.

- Employees who have accrued more than the amounts of basic TD1? ‘Yes,’ or ‘No’ is the answer.

- The reason for this is that QBs Desktop will update the amounts of TD1 on its own for employees who have the fundamental amounts for earlier tax tables.

Issue: QuickBooks Payroll Updates Tax Table is Outdate

When you open the table for payroll taxes in it, a note telling to you, that table of payroll tax is no longer in date may pop up. This issue could result from a variety of different reasons, a few are below listed:

- The first issue is that QuickBooks Desktop may not be up to date with the most recent table of payroll tax releases.

- This issue may also occur if you are using QBs in a network setting of multi-user.

- The final cause may be all QuickBooks versions on network were most updated tax table.

Troubleshooting the Common Error with the Below-Mentioned Steps

- First and foremost, ensure that QuickBooks Desktop is running the most recent software version. In the event of a multi-user network, you’ll need to check all of the versions on network.

- Then, when working in QuickBooks, check the product departure number of presently installed product update messenger. You may also verify the release reference number by using the F2 key.

- If you have not updated the product, it is advisable that you do so as quickly as possible to address the problem. Additionally, a fresh installation of the QuickBooks desktop may fix the problem. First, make a backup of the company file.

Steps to Check your Newest Current Payroll Tax Table

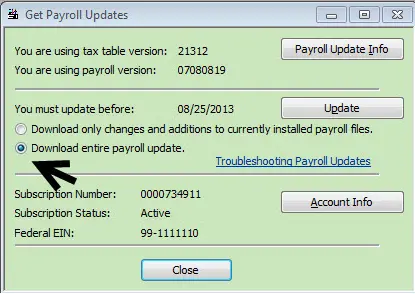

- Choose My Payroll Service from the Employees menu, then hit Tax Table Information from the Employees tab.

- Under the You are using tax table version section, take note of the first three digits shown.

- If you’re currently utilizing the most recent tax table changes, you’ll see 10929004 in tax table information area.

- If you don’t see 109 at the start of the figures, your tax tables are out of the current, and you’ll need to apply the updates using the procedures later down on this page.

Wrapping Up!

It’s hardly rocket science to update a table of payroll tax. Using the procedures listed above, you may easily download, install, and verify tables of QuickBooks Payroll Tax. We’ll wrap off this essay by wishing you luck in downloading the most recent QuickBooks Payroll tax table and gaining a better understanding of it. You’ll find all you need to know about what to do if the QuickBooks Payroll Tax table is out of current here.