How does Quickbooks work? Undoubtedly, QuickBooks is a highly demanding accounting software that offers high-end solutions for managing businesses’ and tax financials. It’s available in various versions like Quickbooks Online, Quickbooks Mac, Quickbooks Windows, and more. Businesses can use this software to automatize tasks like invoicing, billing, payment, and accounting.

There are many versions of Quickbooks and each version works differently for different businesses. This confuses users a lot and they demand an all-in-one guide where they can learn how Quickbooks and it’s every version works. So, this post contains in-depth detail about how does Quickbooks work and helps businesses in automating their finances conveniently. Let’s begin with its features first.

Table of Contents

Most Popular Features of Quickbooks

- User-friendly: The easy-to-use software makes each task simple for users. The most important thing is that the vast features of the software are designed to meet the needs of both small and mid-sized companies requirements.

- Data Migration: The information in the QB software gets effortlessly transferred into the spreadsheet. This is a good option if you want to store financial data in a spreadsheet.

- Simple Sailing Process: It’s easy to determine where your company stands by using Quickbooks software. The process of learning Quickbooks and how it operates is easy and simple to grasp. Additionally, it requires only a few hours.

- Bank Transactions: Each transaction in your company is recorded in a transparent manner. The program will keep track of transactions that are linked to commissions, salaries or salary, profits, expenses, etc.

- Invoice Generation: The software helps in quick invoices generation from Mobile Phones or tablets, or computers.

- Tax Calculations: This feature within QB gives you the ability to calculate the taxes of the company quickly, accurately, and efficiently.

- Business projections: This feature helps QB users to generate future projections. And if any user wants to make reports on expenses, profits, sales, it becomes easy for them to explore the things with their business projections.

How does Quickbooks Work and Help Businesses?

After having a better understanding of what is Quickbooks Software, your curious mind must be thinking about what is Quickbooks used for right? So, let’s explore the points explaining how the software works.

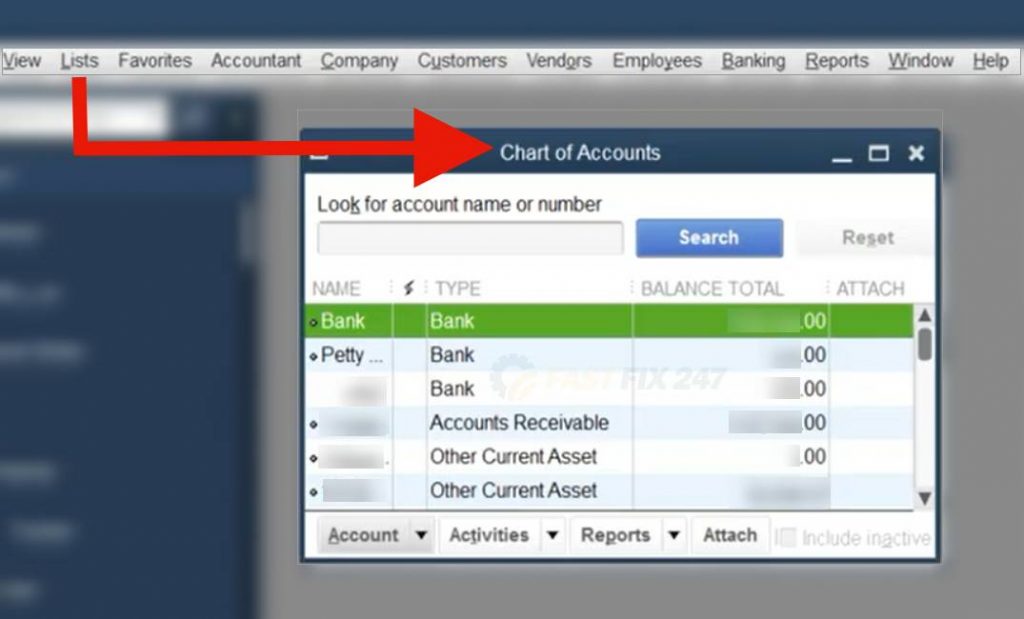

Chart of Accounts

The Chart of Accounts is comprised of a list of liability account, asset, expense, and the equity account for distributing the daily activities.

- It includes the company’s financial data. Information such as dividends, savings accounts receivable, and balance sheets are available in your Chart of Accounts list.

- The window displays account balances and other details like account numbers and contact information.

- The account list will appear just under the “Lists” section inside “Chart of Accounts”.

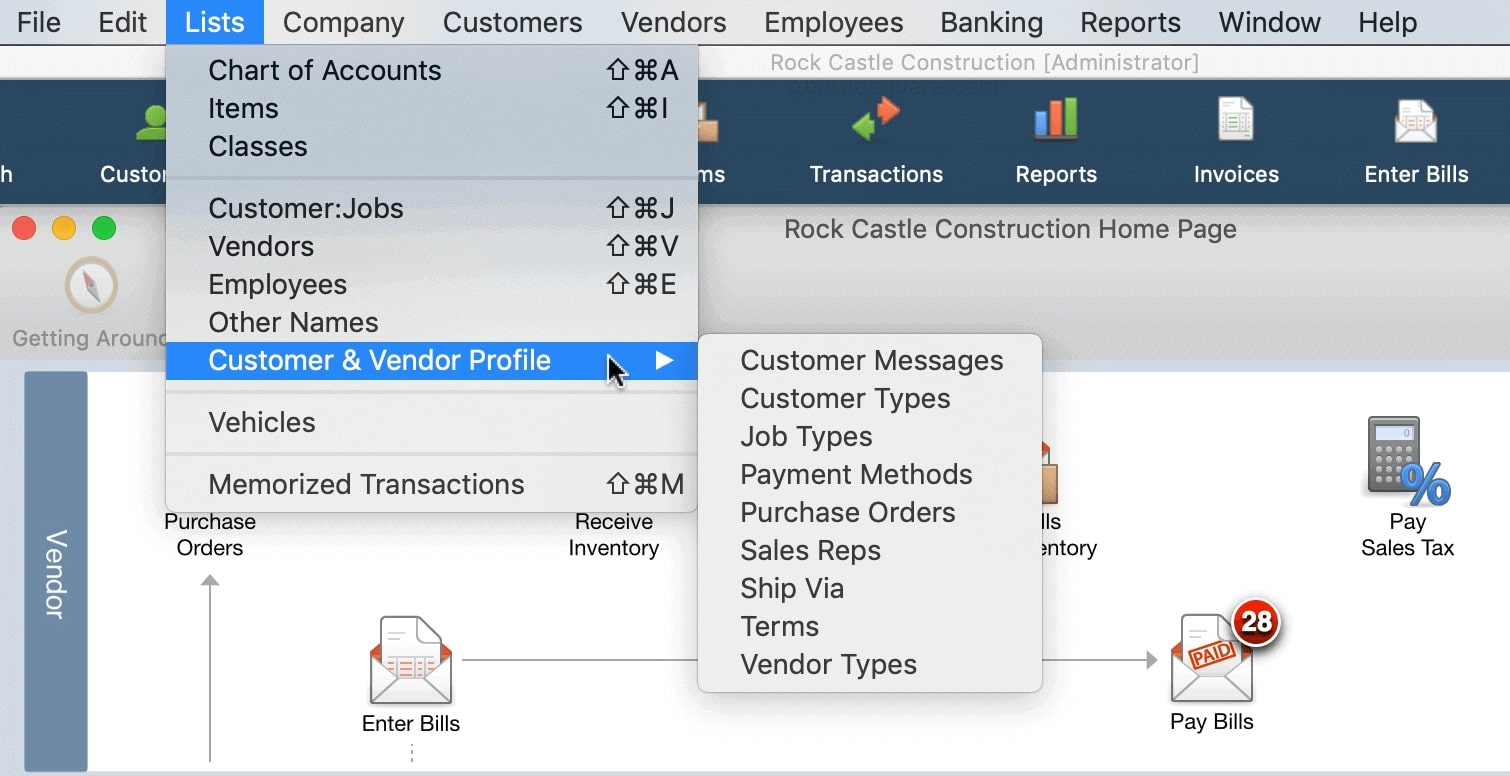

Customer, Vendor, and Item Lists

It is simple to maintain the customer list and vendor Item list in one location. Here’s how it works:

- The accounting software offers you the ideal place to organize your contacts and inventory.

- The client and vendor will have the transactions of the customer or vendor in one place. Additionally, the Inventory Center will offer efficient and effortless management of inventory and non-inventory products.

- Each center will have the option to search or edit, add, modify or remove vendors, customers, and items.

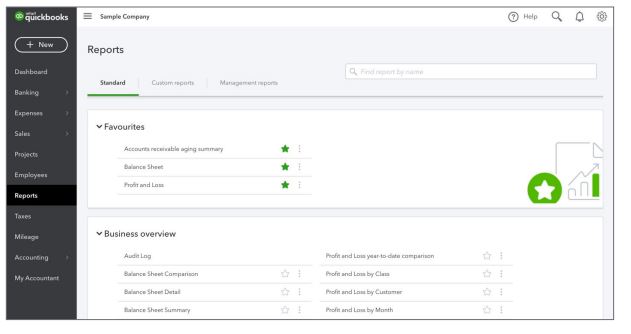

Reports

All reports are accessible via the “Reports” feature, and by using this, it becomes easy for businesses to make smart decisions.

How this Works:

- In the initial phase, all reports must be filled in precisely. To do this, fill in your customer, vendor, and item information.

- Reports can be customized. to filter details by a specific customer, vendor, item, or transaction data.

- Once you run a report you can then add it to your favorite report list. It helps you to access it whenever you want.

Payroll

The self-service application will simplify the administrative processes for the company’s employees. Not only this, it makes payroll processing extremely easy.

How Payroll Works:

- It manages tax-exempt employees, tax forms, workers’ compensation in the Payroll Center.

- A QuickBooks facility is accessible and offers online options to send email receipts and deposits directly.

- Payroll authorizations can easily be assigned to specific users with the multi-user QB account configuration.

Note: You can edit details/info from “Employee Center” for including additional deductions, tips, or details.

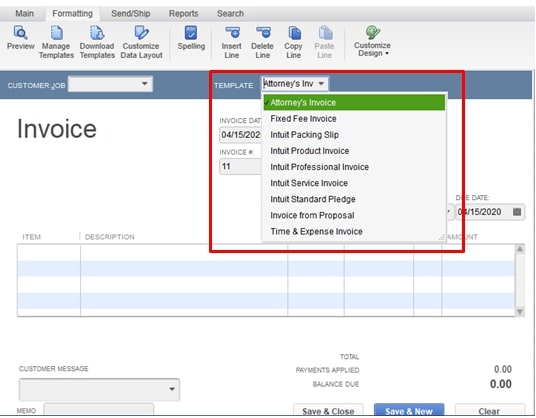

Invoices and Billing

QuickBooks provides two kinds of proclamations, Invoice and Billing articulations. Charge proclamations are issued to a customer with charges that are not specified over a time period.

Charging articulations are recorded in an exclusive register known as “the Customer Register. Receipts work best when things are purchased in one exchange and are not collected after a certain time. For instance, in a book store that arranges for a book the customer may issue the receipt upon request or obtaining the book.

How it Works:

It is easy to create invoices and print them off or mail them out to customers. Thereafter, QuickBooks will track the revenue and keep track of how much each customer owes you. You can check the total amount of outstanding invoices (Accounts Receivable) and the number of days that are overdue.

Different QuickBooks Versions

- QuickBooks Self-Employed

- QuickBooks Online

- QuickBooks Desktop Products

- QuickBooks Pro

- QuickBooks for Mac

- QuickBooks Premier

- QuickBooks Enterprise

- QuickBooks Apps

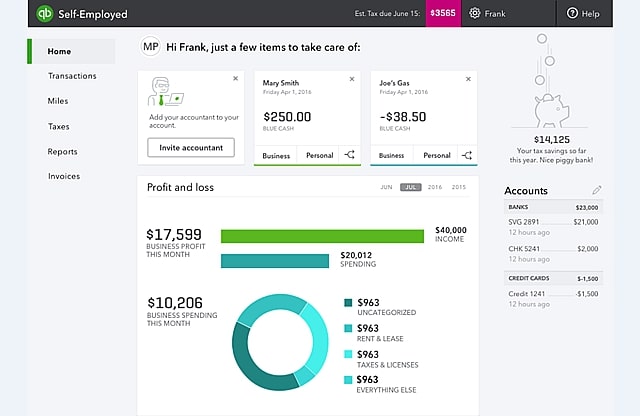

QuickBooks Self-employed

The version of Self Employed is excellent for freelancers, real estate agents, and Uber/Lyft drivers. It allows users to access their work from any location, at any time, and to do this, you just need an internet connection. The most recent version of this line was specifically designed for freelancers and self-employed. The self-employed solution is available in two different packages i.e QuickBooks Self-Employed and the Self-Employed Tax Bundle.

The Self-Employed version enables users to:

- Arrange and monitor IRS Schedule C tax deductions and expenses

- Tracking your income and expenses, keeping separate records to track business and personal expenses.

- It calculates your taxes in a simple manner.

- Users can connect directly to their bank and credit card accounts.

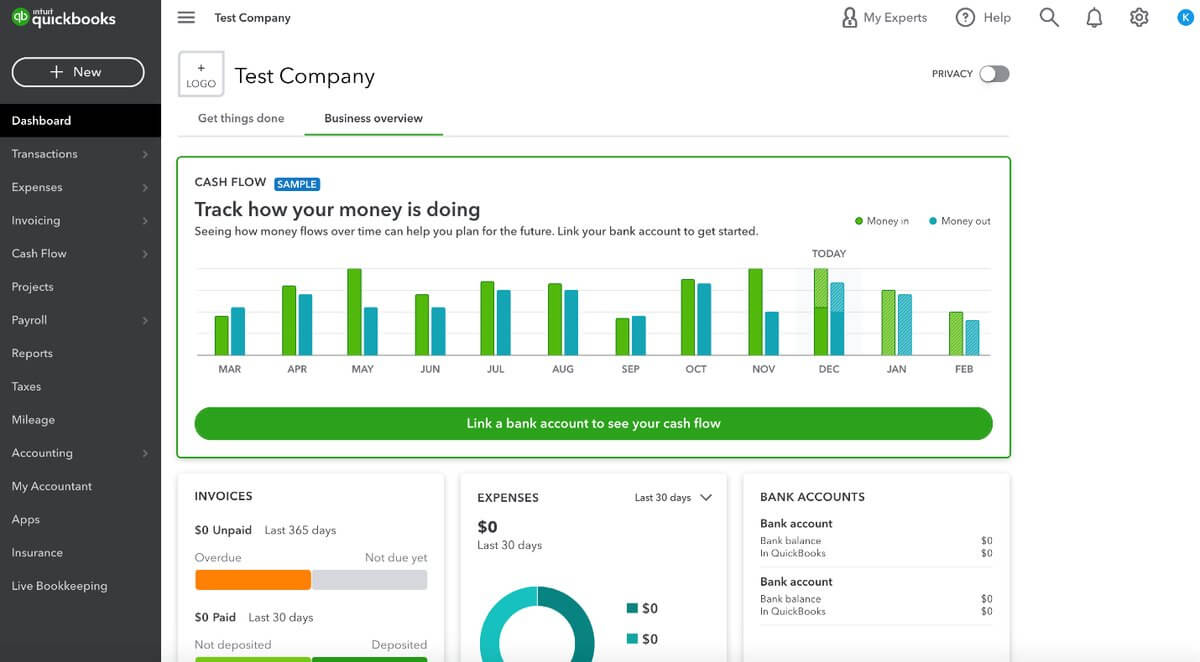

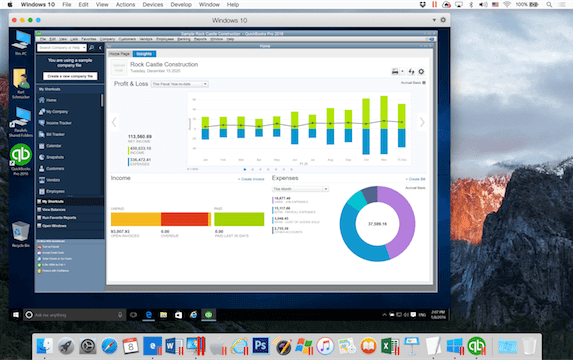

How Does QuickBooks Work (The Online Version)?

Once you register or sign up using QuickBooks Online, you can then access your dashboard’s main view. If you’re switching to QuickBooks from another accounting program, you can import the saved files to the new account.

The main dashboard gives you a comprehensive overview of your QuickBooks account, displaying your invoices, cash flow, sales, expenses, and more.

By using the tab of “Banking (or transactions)” from the left side, you can connect your banking or credit cards. This in turn helps QuickBooks instantly download and classify the transactions for you. When you reconcile your accounts, you can examine these transactions on the “For Review” tab under “Banking”.

Not only this, but you can also modify invoices, establish an automatic sales tax tracking system, and enter bills and mobile receipts. You can revise the company’s account settings by tapping on the gear icon. Want to know where is the gear icon in Quickbooks software? Well, it’s in the upper right-hand corner of the dashboard.

If you want your accountant or bookkeeper to your QBO account, simply go to the tab named “My Experts” and search for the bookkeeper. In the online QB version, you get many Quickbooks Tools such as QuickBooks Connection Diagnostic Tool and QuickBooks Components Repair Tool that repair errors automatically in a single click.

QuickBooks Desktop Products

Users who have product-based businesses with complex inventory tracking use Quickbooks Desktop Products. The QuickBooks Desktop version comes with a custom-designed chart of Account, services, and products lists for manufacturers, wholesalers, contractors, retailers, and more.

It’s come up with a variety of exciting new features. This enhances the reliability and satisfaction of using Quickbooks for professional purposes. You get many products under the Quickbooks Desktop itself. These include:

- QuickBooks for Mac

- QuickBooks Pro

- QuickBooks Premier

- QuickBooks Enterprise

Furthermore, there is: “QuickBooks Apps”

QuickBooks for Mac

This version will manage the financial aspects like generating invoices, expense tracking, creating standard reports of standard format, contributions, and payments. The software is optimized for small businesses that do not want to get involved in manufacturing products.

Major Features of QuickBooks Mac includes:

- An “Income Tracker” dashboard that highlights the unpaid invoices.

- Allows you to design your own budgets for the fiscal year and keep track of your progress.

- It’s an easy task to install and use the accounting software, even if you don’t have experience in bookkeeping or accounting.

- Batch invoicing

- Tailored charts for accounts

- Track multiple departments and locations

- Customer service & product list

- Multi-user access

- Email tracking for customers and vendors

- Forecasting and budgeting

- Square transactions import

- Past due stamp

- Reconciliation Discrepancy Report

- iCloud Document Sharing

QuickBooks Pro

In QB Pro, sharing data and files with your accountant is an easy task for those who have new small-sized businesses. The software is specifically for new businesses, so you can get rapid reports and assistance.

The Pro package comes with the best features like:

- You’ll view orders purchased and unpaid bills among other activities on “Bill Tracker”.

- Users can monitor costs and sales in different currencies.

- Importing files and data from Excel, old QB versions, and other software is easy.

QuickBooks Premier

QB Premier is specifically for small-business users who require specific industry requirements. It’s a great software for retailers contractors, non-profit, contractors, and manufacturing.

Quickbooks Premier Features are:

- Industry-specific reports

- Job costing and estimation

- Details of Budgeting and Forecasting

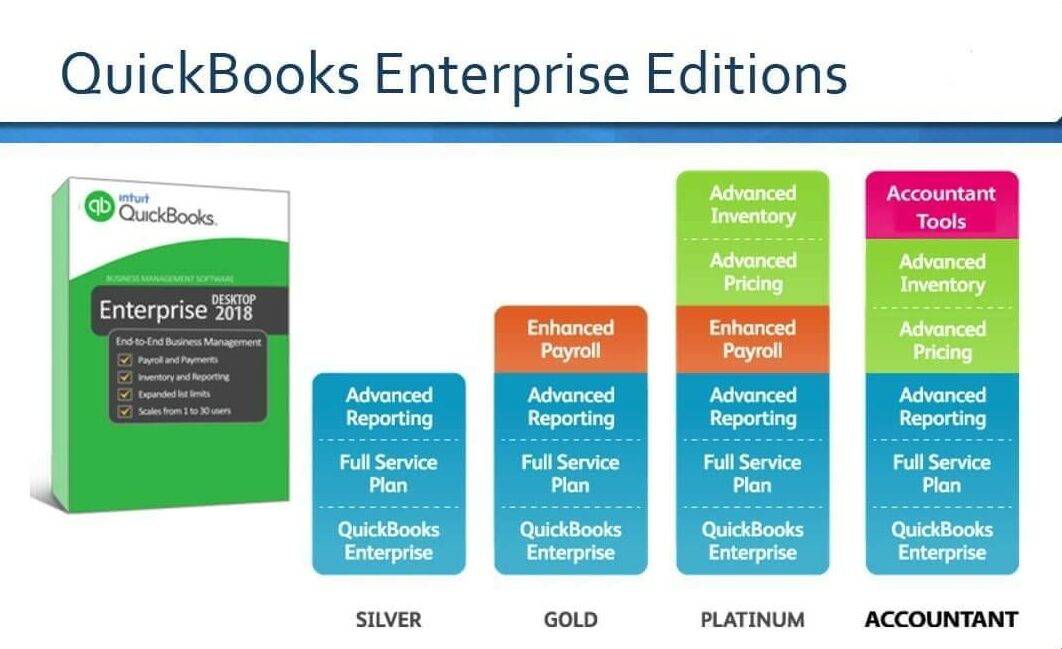

QuickBooks Enterprise

The Enterprise version is ideal for small and mid-sized companies in sectors like retail, construction manufacturing, and distribution. Additionally, with QuickBooks Enterprise 2022 version, all businesses can handle multiple locations, users, inventory workflows, and big transactions. It supports up to 30 users licenses.

QB Enterprise Helps in:

- 14 predefined roles for both users and the admin.

- Multiple users can easily access the files.

- It offers the feature of “Expanded List” which helps users to track 100,000+ employees, customers, vendors, and inventory items.

QuickBooks Apps

In QuickBooks apps, all users’ information is automatically linked. The sharing will happen between the app and the software which will ultimately save users time.

The Following Add-ons are Available at an Additional Cost:

- QuickBooks Payroll – This feature allows companies to pay upto 50 workers through check or direct deposit.

- QuickBooks Point Of Sale – This allows your business to make great sales, approve credit cards, and track your inventory.

Frequently Asked Questions

Q1. Is there a Monthly Fee for QuickBooks Online?

QBO offers four plans for subscription: Simple, Start, Essentials, Plus, and Advanced. The plans start at $25/month up to $180 per month. Each level grants you access to additional features and more users.

Q2. Can I use QuickBooks for Free?

QuickBooks offers countless free mobile applications that let you manage your business from anywhere and anytime.

Q3. Does QuickBooks Report to IRS?

Yes. After completing a Merchant Application, QuickBooks Payments will analyze the information on the application with the IRS data.

Q4. What is General Ledger in QuickBooks?

The Quickbooks general ledger provides a record of each business transaction. The general ledger offers the ability to track business transactions with double-entry accounting. Companies can use the data entered into the journal and consolidated in the ledger to create financial statements.

Q5. Is QuickBooks the Same as Accounting?

Well, QuickBooks manages the finances of a business, so it is definitely the same as accounting to a major extent. It’s accounting software that tracks and organizes your financial records eliminating the need to enter data manually. It automates tasks like invoicing, accounting, sales tax management, time tracking, financial planning, bank reconciliation, and a lot more.