QuickBooks Audit Trial Removal Service is essentially a service to get rid of the audit trail from a QuickBooks file. This can scale back the size of the file by a maximum amount of 30-50% and significantly speed up the information file. This service also will delete entries within the Voiced/Deleted Transactions outline and Detail reports. Let’s see how the QuickBooks audit trail removal turns off work.

Table of Contents

What is the meaning of QuickBooks Audit Trail?

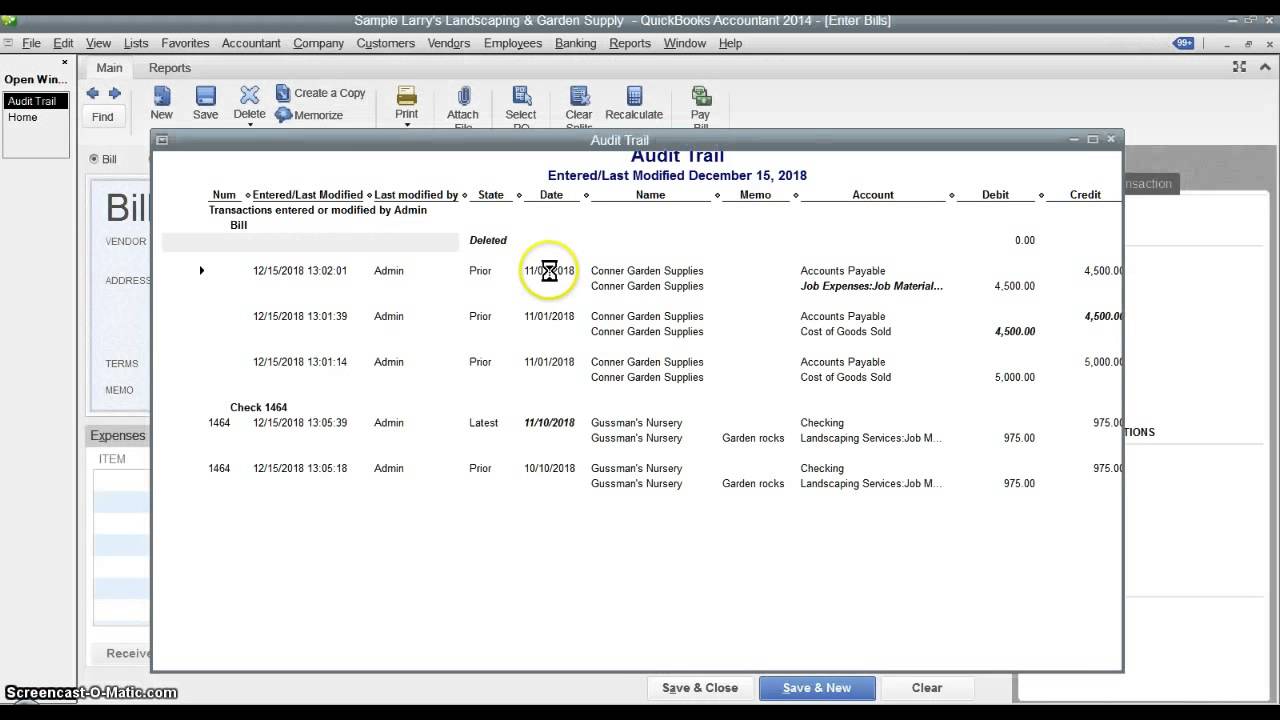

QuickBooks maintains an inside Audit path to record all changes created to each dealing within the record. This is an often tremendously useful tool for Accountants/Bookkeepers to trace users who have created changes to transactions and different details like amounts, etc. However, because the variety of transactions increase in every record, the audit trail grows by an element of two, thereby increasing the scale of a QuickBooks record. Removing the audit trial brings down the file size of the data file and accelerates QuickBooks. It’s additionally typically needed to get rid of the audit trial once returning data files to the government or different agencies like the CRA and federal agency in cases of data audits.

Does Removal of the Audit Trail Affect QuickBooks?

Well, like every other myth this is also not true. Instead, removing the audit trial helps in keeping a low file size with enhanced performance of QuickBooks.

Read:How to fix Quickbooks error 3371

How does QuickBooks Audit Trial Removal work?

Let’s have a detailed look at how this happens.

QuickBooks Audit Trail’s Working Explained

QuickBooks online maintains a log of every monetary group action because it is added, changed, or deleted. The Audit Log is an audit path that enables you to see precisely what changes were created, and who created them. This is typically an associate degree awfully great tool for Accountants and Bookkeepers to trace users who have created changes to transactions and totally different details like amounts, etc.

There square measure a number of things to understand regarding the Audit Log.

- To access it, you want to have full access rights.

- For audit and security reasons, you can not disable it.

- You can use the Audit Log to analyze changes created to private or multiple transactions. The info you will find includes:

- The date of the amendment

- The name of the user who earlier created the amendment.

- Type of amendment or event.

- The name of a client or merchandiser associated with the amendment and any original group action date and quantity.

In addition, for many transactions or events, you’ll be able to choose to read within the History column to open the Audit History, Particularization changes to private group action or event.

How to run Audit Trail Reports?

- To run the Audit Trail reports you have to follow the following instructions:

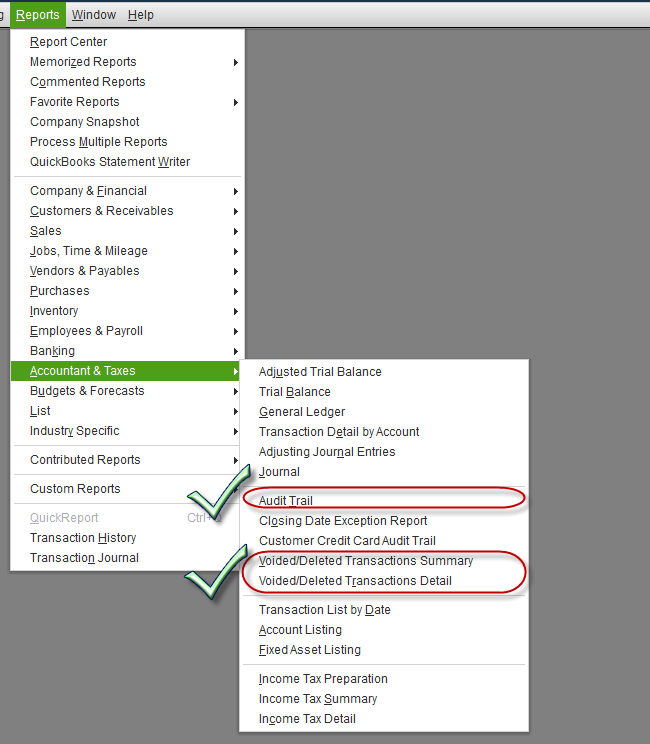

First of all, go to Reports. - Now, click on Accountant & Taxes.

- Here you will see these two reports.

- Report 1: Audit Trail

- Report 2: Voided/Deleted Transactions Summary or Detail

Read - How to do QuickBooks Auto Data Recovery.

What are the benefits of an Audit Trail Report?

One of the troublesome issues that controllers and bookkeepers typically encounter, is making an attempt to find missing or historical transactions. At times, there are instances when you just have entered any specific transactions, however, you’re unable to seek out it in the chart of accounts or the other company files.

Audit trail report provides the fingerprint of every single dealing that you just have recorded in QuickBooks Desktop. For instance, by using Audit Trail Report you’ll be able to simply check all the changed transactions, entries, deleted transactions and even voided transactions.

What are the Demerits of the Audit Trail Report?

As the variety of transactions increase in a very record, the audit trail grows by an element of two, thereby increasing the dimensions of a QuickBooks record, and decelerating QuickBooks down significantly.

You might be interested in reading,How to Fix Negative Inventory in QuickBooks?

What does the Audit Trail Removal do?

Removing the audit data brings down the file size of an information file and fastens QuickBooks. The Audit trail Removal Service could be a service to get rid of the audit trail from a QuickBooks record. This may scale back the size of the data file by the maximum amount of 30-50% and significantly speed up the information file. This service also will delete entries within the Voiced/Deleted Transactions outline and Detail reports. It’s additionally usually needed to get rid of the audit trail once turning in knowledge files to the government or alternative agencies like the CRA and Internal Revenue Service in cases of data audits.

Removing the audit trail knowledge doesn’t impact QuickBooks in any means however rather helps in maintaining an occasional file size and improved performance in QuickBooks. This service works for QuickBooks U.S., Canada, UK, AU, and NZ knowledge files.

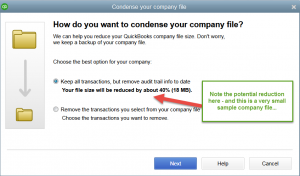

The Process to Remove the QuickBooks Online Audit Trail

- First of all, launch the QuickBooks Desktop software.

- Now, look for the utility option.

- It’s time for you to choose either the clean-up company data option or condense data option. It depends on the version of the QuickBooks Desktop you are using.

- Next, you have to select the range of the data from when you wish to clear the audit trail.

- You may have to tick all the boxes that appear on the screen.

- Finally, initiate the clean-up.

You can also perform the same process to clear audit data in QuickBooks Enterprise for Mac.

Hurray! We have reached the end of the article. Congratulations! now you are an expert in clearing the QuickBooks audit trail data. All the year’s QuickBooks versions like turn off audit trail in QuickBooks 2014, turn off audit trail in QuickBooks 2016, and turn off audit trail in QuickBooks 2018 have been explained in this post.

Frequently Asked Questions

Q1. How do I track user activity in QuickBooks?

Using the Audit trail report, you can see what your users are doing on your company file. You can do this by following these steps:

- Navigate to the Reports menu.

- Select the option Accountant & Taxes.

- Lastly, choose the Audit Trail option and you can easily track the user activity in QuickBooks.

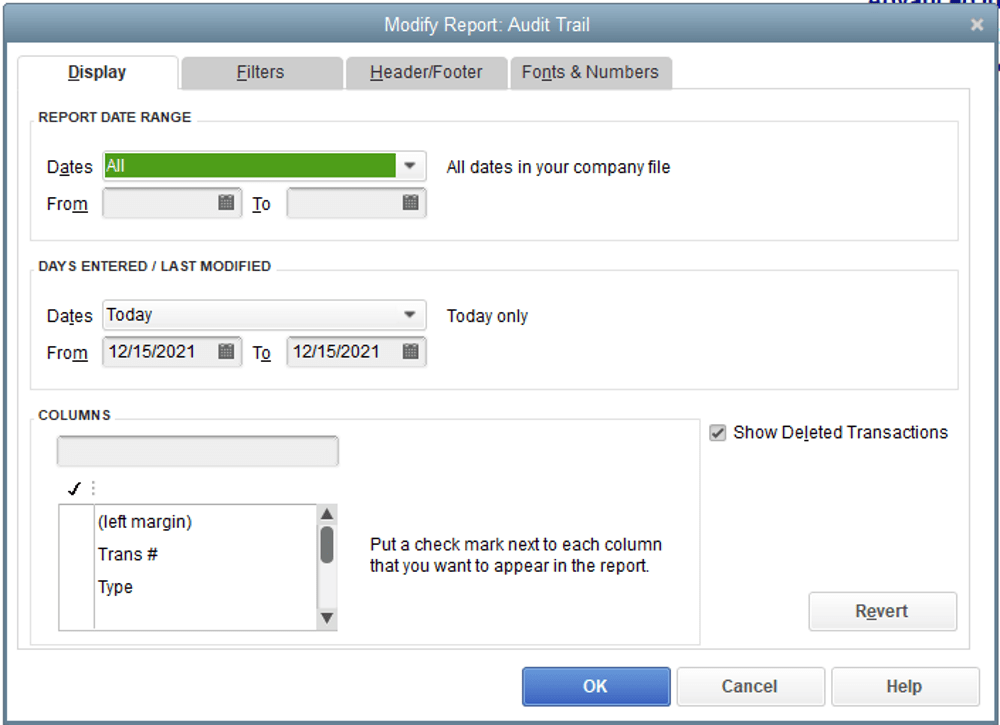

Q2. How do I filter an Audit Trail in QuickBooks?

To filter Audit Trail in QuickBooks, follow the steps given below.

- From the Reports tab, choose the option Account & Taxes.

- Select Audit Trail and click on Customize Report.

- From the Filter tab, search for the Transaction type.

- Choose Invoice and tap OK to filter the dates.

Q3. How do I view audit logs in QuickBooks?

Log in as an admin to view the audit log. In case you can’t find it, ask your primary admin.

- Select Audit Log in Settings and choose Filter.

- To narrow the results, select a User, Date, or Event filter from the Filter panel.

- Tap on Apply.

At a time, the audit log displays 150 records. In most cases, you can view the audit history by selecting View in the History column.