If you want to initiate direct deposits for your employees but are unsure how to do it, this article is for you. In this article, we will go further into QuickBooks direct deposit and discover what it’s all about. Moreover, we will get to learn about the QuickBooks direct deposit form.

Direct Deposit in QuickBooks helps the employer to gain all the information about their employees to handle the payroll. This can gather the bank details of employees and all the important authorization in order to pay the employee’s salary with the help of the standard form of direct deposit.

Table of Contents

Details Explanation of QuickBooks direct deposit form

Direct deposit is a method of moving funds from one account to another account through digital or electronic mode. Moreover, you can quickly compensate your employees via intuit direct deposit in QuickBooks payroll. Furthermore, you can use their savings, money market, or checking accounts to do so.

Additionally, it uses to conveniently distribute employee paychecks without being physically present there. You may use this to transfer funds from your account to the employee’s bank account. Using direct deposit has advantages for both the employee and the company. Also, to avail of this service, you need to fill out the direct deposit authorization form QuickBooks. Moreover, you can apply the QuickBooks direct deposit form in various situations, and the common ones are as follows:

-

Pay of the Employee

Many firms use direct deposits to pay their personnel. Employers benefit from increased convenience and decreased expenses. It makes payday a snap for employees. After clearing through ACH, the money you earned are, however, deposited into your account.

-

Refund of a Tax

The United States government likes to pay its residents by direct deposit because both parties have secured and simplified it. Moreover, if you owe a tax refund, you will get it by direct deposit. So, if you don’t own a direct deposit account, set it up to receive a rapid transfer from the IRS.

-

Stimulus Checks

The U.S government delivered emergency assistance stimulus cheques in 2020 under the CARES legislation. Moreover, citizens who opted into the IRS direct deposit program got cheques in the bank account listed on their tax returns.

Know - What is Quickbooks Self Employed Version?

Working on Direct Deposit Authorization Form QuickBooks

The company distributes the paycheck using the employees’ direct deposit information and via QuickBooks direct deposit form. Following that, on payday, your financial institution deposits the money into your account. However, the payments are eventually made into the employer’s account within two working days. This digital financial transfer is simple and advantageous to both parties.

How to Fill out QuickBooks Direct Deposit Form?

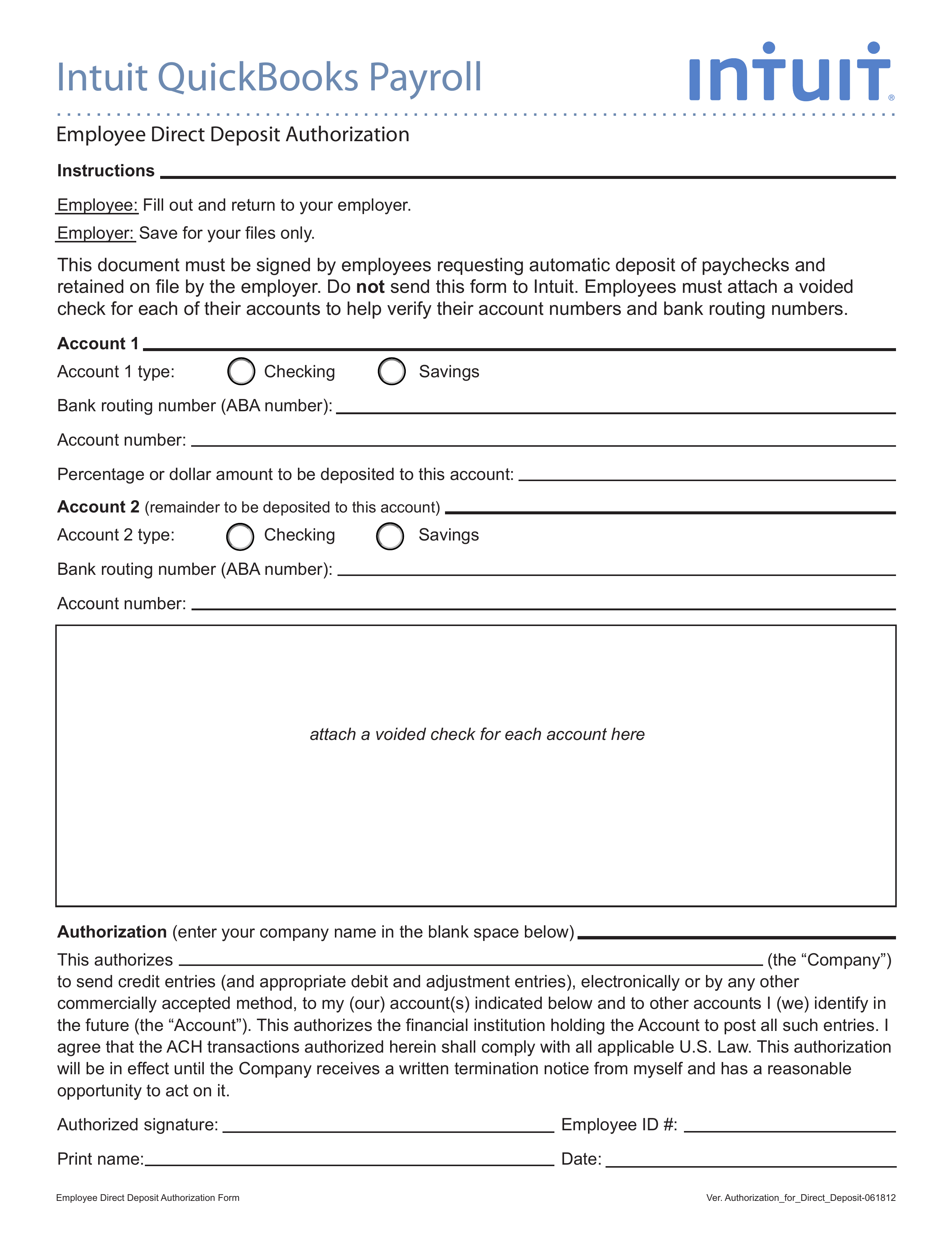

Before completing the QuickBooks direct deposit authorization form, please read the instructions. To begin with, you do not need to send the paper to Intuit. Instead, for each bank account, the employee must fill out the intuit QuickBooks direct deposit form and attach a voided check. The voided checks will go to use to confirm the account numbers and bank rounding numbers. You may fill out the form by following the procedures shown below:

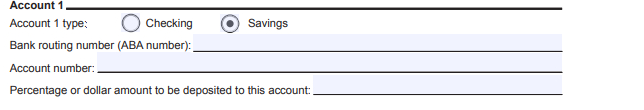

Begin With Labeled Area Account 1

- At first, choose Checking or Savings as your account type.

- Then, enter your bank’s routing number (ABA number.) It is a nine-digit code that varies based on the location of the bank where you created your account.

- Enter your Account Number.

- Also, input the ‘Percentage or Dollar amount deposited into this account.’

- In case the payment amount is probably split between two accounts, specify a percentage less than 100 percent.

- If you do not give information for a second account, a check form will be surely sent.

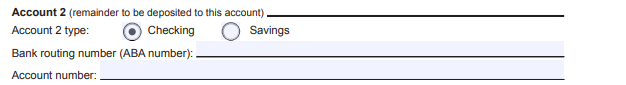

Follow the Same Steps, if you Want to add Account 2

If you wish to add a second account, follow the same instructions. The percentage of the money that did not go to the first account will be eventually transferred to the second one.

- First, choose the Account Type: Checking or Savings.

- Then, enter the Bank Routing Number (ABA Number).

- At last, input the second account number.

For Each Account, Provide a Voided Check

- Attach a voided check for each account, which will be used to validate the account number as well as the Bank Routing Number (ABA number).

- Ensure that after printing the full form, attach the voided checks.

Input Your Company Name in the Space Provided

- In the space provided, enter your company name.

- This is an authorization for the firm to electronically transfer money into your account and subtract any amount that may have been put in error.

Fill in all Required Details for Authorization

- Enter the remaining information for authorization reasons, such as employee ID, print name, date, and authorized signature.

Once you have completed the direct deposit forms QuickBooks and printed them, attach the voided checks for each account. Then, send the completed form to your human resources department. Following that, your company will complete your application and set up a direct deposit of your salary into your account.

Instructions on How to Set up Direct Deposit for Employees

It is necessary to understand that the employees must complete a direct deposit authorization form QuickBooks and present a void check for their bank account. It’s not a bank deposit slip. The intuit QuickBooks payroll form and void check are strictly for your records. Moreover, it is not necessary to send them to Quickbooks Desktop. In addition, it takes around 7 business days on average to set up a direct deposit on a QB desktop, which includes validating your company’s bank account for security considerations.

Furthermore, you need to do the following things before using QuickBooks direct deposit form.

- Firstly, check your bank account.

- Secondly, in QB, enter your employee’s bank account details.

After completing the above things, follow the outlined process to set up direct deposit form QuickBooks for employees.

Configure the Company Payroll for Direct Deposit:

In order to configure the company payroll for direct deposit, follow the below steps:

- First, obtain the details of your business, principal officer, and bank, which include the following:

- Company name, Business address, and EIN

- Social security number of the principal officer, home address, and your date of birth

- Bank information (user Id and password) and bank account numbers

- Then, connect with your bank account. To do so, follow these steps:

- Launch QB in your system

- Then, log in using your correct credentials

- After that, navigate to the Employees menu

- Following that, choose the My Payroll Service tab

- Then, tap on Activate Direct Deposit

- Now, choose the Get Started tab. In case the buttons are not available, follow the below instructions.

-

- Hit I’m Admin and I’m the primary person who….

- Then, input the admin email ID and User ID

- After that, hit Continue to start

- Then, you need to input either an Email ID or User ID and password to login into your Intuit account.

- After that, press the tab Sign in

- At last, press on getting started

- Click the Start button under the business tab and then mention all of the information.

- Then, hit Next

- Now, you need to provide the information of the principal officer and then hit on Next

- After that, add a new bank account

- Also, provide the name of your bank with the necessary credentials. If prompted for an account number, you need to provide the details.

- Moreover, create a PIN for your bank account. Make sure to provide this pin whenever you make a payment or payroll.

- Then, hit Submit

Read about: How to use Quickbooks Loan Manager?

Few More Pointers to Consider:

- Following that, tap on Next and then you need to select Accept and Submit

- If prompted about the principal officer’s full social security number, ensure to submit it.

- On completion of the process, you may receive any of the below-mentioned messages:

-

- Thank you for signing up for the QuickBooks direct deposit

- Your bank account is now linked.

- In case your bank account is not connected automatically, you need to verify your bank accounts in QB.

- Now, in order to set the direct deposit, you need to enter the employee’s bank account information.

- At last, you are ready to pay your employees. In this step, after creating the paychecks, send the direct deposit to Intuit. Normally, it takes about two working days to complete the process. After the completion of the process, the paychecks are successfully deposited directly in the employee’s bank account.

Get the QuickBooks Direct Deposit Form:

Obtain the direct deposit authorization form QuickBooks, as well as a voided check from your employee’s bank account. These items are for the employees’ records. You don’t need to submit it to the QB. This allows you to keep records of your staff.

Add Direct Deposit to Your Employees

If the Employees bank confirms that the account should be designated as a money market account, you must notify the employees. Also, inform them that only saving and checking accounts are going to be accepted by the QB. Out of these two, you must choose the Checking option. The steps for checking are outlined below:

- First, in QB, go to the Employees tab.

- Then, from the drop-down menu, pick the tab Employee center. It displays the Employee list.

- Then, you must enter the employee’s name first, followed by the Payroll details tab.

- After that, click the Direct deposit option. Here, the Direct Deposit window appears.

- Now, choose “Use direct deposit for.” Here, you need to enter the name of the employee.

- After that, choose whether you want the paycheck deposited into one or two accounts.

- You must now provide the financial institution details for the employee. The data comprises the bank’s name, account number, routing number, and account type.

- In case you wish to deposit in two accounts, enter the percentage or amount that the employee wants to deposit in the first account in the Amount deposit section.

- The remaining funds have to store in the second account.

- Now, press the OK button to save all the data.

- Finally, when prompted, provide your direct deposit PIN to complete the transaction.

Also read: How to Delete a Deposit in QuickBooks

Advantages of QuickBooks Direct Deposit Form for Employees

Employees profit from direct deposits in a variety of ways. The advantages are as follows:

-

Simple Budgeting

Direct deposit is the finest automatic solution for you if you want to build up a savings account and reduce your debt expenditures. When you enable a direct deposit, you can request that a portion of your paycheck is merely put straight into your bank account.

-

No Need for Paperwork

When you convert to direct deposit form QuickBooks, you can say goodbye to paperwork. Direct deposit ensures that everyone has a digital record of all electronic payments, eliminating the need to physically record pay stubs.

-

Convenience

You will not need to go to a bank to deposit your paycheck. You also save time by not having to wait in a long queue. Thus, direct deposit is convenient. It enables the financial institution and the payer to execute the transaction by interacting with one another.

-

Eco-Friendliness

The use of paper in the process is an environmentally beneficial step. Everything is solely done digitally, which means there is no paper involved. As a result, switching to direct deposit is a wise decision.

Wrapping Up!

By following the above steps, you can quickly set up your QuickBooks direct deposit authorization form using the direct deposit authorization form QuickBooks. In order to avoid processing delays, make sure you have all of your company and bank account information, including your employee’s bank account information. After completing the setup procedure, you can begin issuing same-day or next-day paychecks to employees.