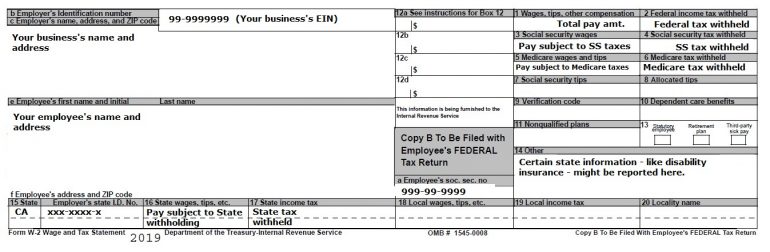

Employers deliver the QuickBooks W2 form to every employee after each fiscal year. This is a vital document that has many important items for reports, tax-related purposes as well as withholdings. It also includes the necessary insurance for employees which is a little different from employees who are independent contractors. In addition, it also allows for the option of deducting taxes from the pay of the employees.

To prepare the tax return, all of the provided information is important. Employees should keep multiple copies of the QuickBooks W2 form, and after this, they must forward it to three other parties namely the federal government as well as the state government as well as the individual.

Table of Contents

Why is QuickBooks W2 Form?

The W2 form functions as a tax and wage statement. It simply shows how much an employee made that particular year as well as the amount of tax the employers have already paid for tax purposes to the IRS.

The form isn’t necessary for anyone. The independent contractor, and others who are self-employed need a 1099 form in lieu. If the employee has earned at least $600 for the year in question then you’ll have to give an official W2 before the 31st of January deadline.

Benefits of Using QuickBooks W2

The W-2 form plays an internal purpose within QuickBooks. It contains social security reports, medicare tax reports, tax statements, and the employee’s salary-payed report. This form is stated to the employee and the IRS each financial year.

However, you will learn how to print the W2 using QuickBooks updated Desktop 2022 in this post. In addition, you will learn the process of printing using Form W-2.

How do I Create a QuickBooks w2 Form?

You must follow the below-mentioned steps to know how to print w2 in QuickBooks.

- Choose your employees, W-2s, and tax forms for Payroll, when you are ready to process Payroll Forms.

- Click on the annual Form W-2/W-3 wage and tax statement/transmittal.

- Press the Create Form button.

- Below, choose the filing period following the year.

- Enter the year which you’ll need to print the form for W-2.

- Select OK.

- The message could appear on your screen, but only one version of the tax form.

- Then, hit the “OK” button.

- You must now follow the directions on the screen to complete the form.

Tips to Keep in Mind Before Printing the W2 Form in QuickBooks

Here are some crucial aspects you should remember to printing the w2 form.

- Ensure you are running the most recent version of QB.

- Make sure to have a payroll account active and the payroll tax table is current.

- Check the form is compatible with the current version of QuickBooks.

- Be sure to place your paper horizontally within the printer.

How do I Print a W2 Form in QuickBooks?

Before learning the method to print the W2 form using QB online, we need to learn the prerequisites to know how to print w2 in QuickBooks desktop 2022.

The W-2 Printing Requirement Forms in QuickBooks

We are going to guide you through the forms you need to fill out before printing your W-2 using QuickBooks.

- When printing the W-2 forms It is essential to make sure you are using the most recent version of QuickBooks. The most current version should have compatibility with the Windows OS installed on your system.

- The payroll service needs to be in operation.

- The W-2 document should be compatible with both the printing service and printer.

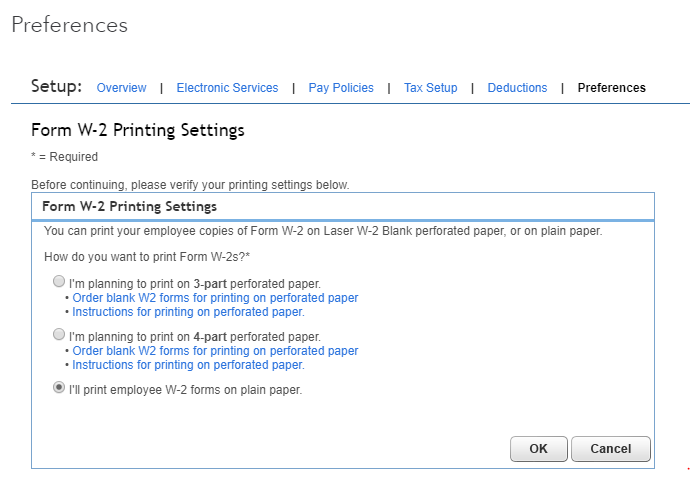

- Although, you can either use perforated or blank paper, or the pre-printed type of inkjet printer. You can also make use of printed inkjet printer papers that are pre-printed.

- Check to see if you have the most recent version of the table of taxes on the payroll.

Therefore, once you’ve identified the prerequisite needed to print the W-2 Form, let’s begin the process of printing your W-2 form online.

How do I Print the W2 Forms Using QuickBooks Online?

In general, QB requires the purchase of a payroll subscription for printing the W2 form. The following are the steps that you have to follow to print the W2 online.

- Start the QuickBooks software.

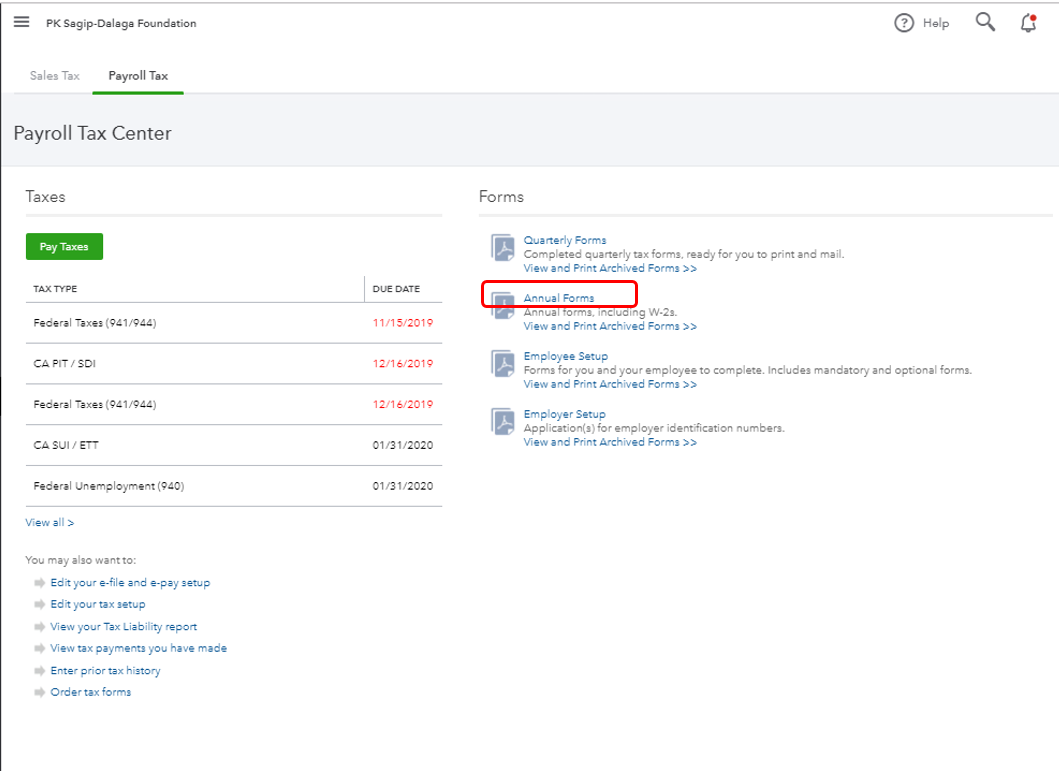

- Find the tax option.

- Select the payroll tax.

- The next step will determine the Formulas section.

- Click on the Annual Form link QuickBooks.

- Find the drop-down menu to select the specific employee’s name or all employees depending on your preference.

- Select the copy of the W-2, BC 2, and 3 links.

- Once you have completed it Once it is done, you can print copies of the employee’s Formula W-2 page.

- Choose the ideal date from the drop-down list displayed on this webpage.

- Click on the view button to start Adobe Reader. Adobe Reader in a new tab.

- Click on the Print icon on the Reader toolbar.

- Then, click the Print option.

Wrapping Up!

A W2 form is a form that contains important information such as wages and salary of the employee which is paid by the employer. In the above article, we have explained all the details regarding this form. We have also explained how to print this form without taking anyone’s help. Read the whole article carefully to understand the process easily.

Frequently Asked Questions

Q1. Printing W2 can be Done onto Plain Paper From QuickBooks?

Yes, printing and distributing W-2 forms to employees using simple paper.

Q2. How do you Print the Employee’s Wage Slip From QuickBooks Online?

- On QB online, click on the tabs for taxes and the Payroll Tax section.

- In the section for forms Click on the annual form.

- Click on W2, Copies B, C & 2 to download the employee’s printout.

- Select View to display the printable forms, then click on the icon for printing.

Q3. Through ADP Can I Make a Copy of my Form W-2?

If your current employer gives you online access to access your pay data You can sign into the site to access the W-2 online.

Q4. How do I Print the pre-W2 Forms Using QuickBooks?

- Choose the employee’s payroll center.

- Click on the File Forms tab.

- Click to view/print the form and W2S.

- Enter the payroll pin.