Anybody who uses QuickBooks for their business, adapting the QuickBooks home accounting software for your personal finance is a useful idea to manage everything quickly and easily. It has many features that help you manage and track your finances, see patterns, pay bills, and spot any concerning areas through reports that you can set in no time. In this way, QuickBooks for personal use gives you full control over your finances.

Also, you can use QuickBooks personal to track your monthly budget or savings for managing important things like education. It makes your life much easier by helping you handle your home or business finances from any part of the world. This post will help you find out how you can use QuickBooks for personal finance management and its features that make you manage your finances quickly and securely.

Table of Contents

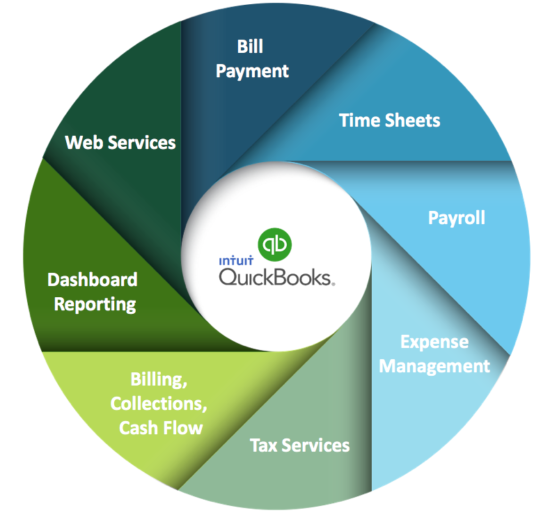

QuickBooks For Personal Use | Top Features

QuickBooks accounting software has remarkable features that make it best for personal use and managing finances. And now you can run your family or business finances from anywhere without hiring a home accountant. Let’s check out how.

Various Payment Integrations: QuickBooks gives you different types of payment options with apps like Stripe, Expensify, and PayPal.

Streamlined Bank Feeds: If you invest a lot of time in entering the bank transactions monthly, then this feature will help you. You can automatically categorize all the bank transactions in detail using batch editing, enhanced rules, and improved matching.

Automated Receipt Management: If you spend a lot of time entering receipts manually, then this feature is helpful. QuickBooks can now automatically create and categorize all the receipt expense transactions by the mobile app that captures receipt data. You just have to take a picture, import it, and then review it.

You Might Want to Know How to Undo Reconciliation in Quickbooks Online

Automated Statements/Payment Reminders: Another useful feature of QuickBooks is that it reminds your customers of their overdue balances and sends them statements. You can also leverage QuickBooks for personal use to send statements by attaching payment links to motivate customers to settle their balances immediately via a payment portal.

Setup and Reuse Email Templates: With QuickBooks, you can create or reuse many templates to communicate with your customers via email. With this, you can save, store and even remember email templates for future use.

Customization: With QuickBooks Online, you can create custom invoices and add a payment link to them for more convenience. Also, you can add a bank account number or a credit card to the invoice directly for instant payment. Now you might have got a basic idea of the features QuickBooks offers, now let’s understand how QuickBooks for personal use exactly works!

How Does QuickBooks for Personal Finance Work?

1. Control Cash Flow

One of the most useful features of personal QuickBooks is controlling cash flow. Cash flow is the movement of money into and out of your business or household. And QuickBooks allows users to track their income and expenses and create budgeting goals which ultimately improves cash flow.

Additionally, you can use the same information to create a spending plan that ensures all bills are paid on time, and enough money is available to cover unexpected expenses. Moreover, QuickBooks can also be used to track investments and savings, making them a valuable tool for anyone looking to take control of their finances.

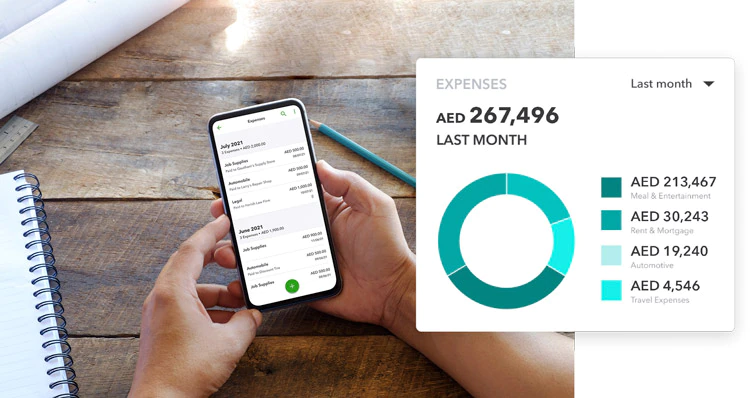

2. Tracking Expenses

Another important aspect of QuickBooks for personal use is it tracks your income and expenses. This information is then used to prepare financial statements, which can be used to make important business decisions. Also, QuickBooks allows users to categorize expenses and track them over time. This can be extremely helpful in spotting trends and making adjustments to spending.

Additionally, you can use QuickBooks to generate reports that can be shared with others, such as investors or lenders. This information can give them a better understanding of the business’s financial health.

3. Scanning Receipts

If you are self-employed or run a small business, then you know how important it is to keep track of your expenses. This is where QuickBooks for personal use helps you a lot. It helps to scan your receipts and save them electronically with a number of tools.

- First, personal QuickBooks can be used to create digital copies of your receipts. This is done by using the camera on your computer or phone to take a picture of the receipt. The image can then be stored in the QuickBooks system for later reference.

- Second, QuickBooks can be used to organize your receipts. This is especially helpful if you have many receipts that need to be sorted and categorized. QuickBooks allows you to create folders and subfolders to store your receipts, making it easy to find what you are looking for.

- Finally, QuickBooks can help you keep track of your spending by categorizing your receipts. This helps determine where your money is being spent and identify areas where you may be able to save money.

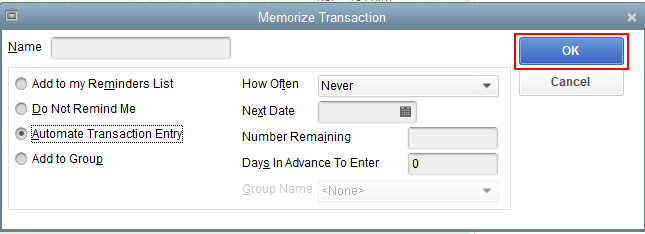

4. Memorized Transactions

One of the most helpful features of QuickBooks personal use is its ability to memorize transactions. This means that once you enter a transaction into QuickBooks, you don’t have to re-enter it each Time it occurs. This can be a huge timesaver, especially if you have to process many transactions daily.

There are a few different ways to set up memorized transactions in QuickBooks. The most straightforward way is to use the “Memorize” button that is available on most screens where you enter transaction information. Alternatively, you can go to the “Edit” menu and select “Preferences.” From there, you can choose the “Memorized Transactions” option and set up your transactions accordingly. Whichever method you use, QuickBooks makes it easy to save Time by memorizing your frequent transactions.

6. Estimating Taxes

For individuals, Quickbooks personal use can help estimate how much tax they will owe at the end of the year. QuickBooks calculates tax estimates using information from the user’s financial transactions. It takes into account things like income, deductions, and credits. Based on this information, it produces an estimate of the user’s tax liability. This can be a helpful tool for both businesses and individuals in managing their finances and planning for tax season.

7. Automate Bills to Save Time

QuickBooks also offers some features to help businesses comply with payroll tax laws. For example, the software can generate W-2 forms for employees and print 1099 forms for contractors. QuickBooks can also help you file quarterly and annual payroll tax returns.

In addition, QuickBooks offers a direct deposit feature that allows businesses to deposit employee paychecks directly into their bank accounts. Overall, QuickBooks is a comprehensive payroll management tool that can save businesses time and money.

8. Accept Online Payment

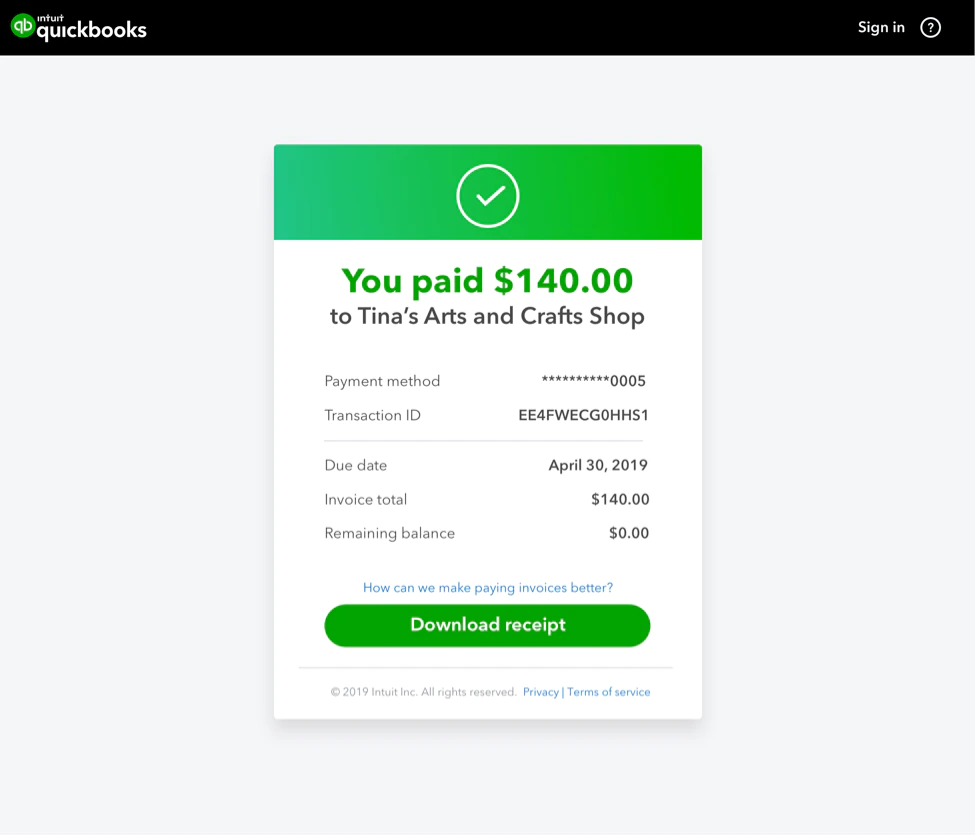

One most important reason for leveraging QuickBooks for personal use is it offers the ability to accept online payments. This can be a great way to streamline your business operations and make it easier for your customers to pay you. There are several benefits to using QuickBooks for online payments.

- First, QuickBooks can automatically record and reconcile your payments. This means that you won’t have to track who has paid you and who hasn’t.

- Second, QuickBooks can send out automatic reminders to customers who have outstanding balances. This can help you avoid late payments and reduce the amount of time you spend chasing down payments.

- Finally, QuickBooks integrates with many popular payment processors, making it easy to accept payments from various sources. Whether you’re accepting credit cards, PayPal, or bank transfers, Quickbooks personal use can help you get paid quickly and easily.

9. Team Collaboration

QuickBooks also gives access to accounts to many employees and partners, including managers, sales reps, etc. This custom-type access helps you share insights with business partners and investors. Plus, you can send an invitation to an accountant to collaborate via a separate account.

Some Last Words

Now you might have understood how you can use Quickbooks for personal finance and cash flow management. With this software, you will never have a hard time tracking your personal finances. We hope this guide helps you give insights on how to leverage QuickBooks for personal use and reap its maximum benefits. Also, you can check out our website to get more QuickBooks related articles and guides.

Thankyou for your time!!