“I was having a great day until I got an email from my accountant with the subject line: “Error 3180 QuickBooks.” Apparently, there was something wrong with my QuickBooks file and I needed to take care of it right away. Otherwise, I could face some serious penalties. I wasn’t sure what to do, but I knew I needed to fix the problem fast. So, I started researching online for solutions. And thankfully, it only took me about an hour to fix this frustrating error.”

Today we are here for the same to help you out and give a detailed analysis on the QuickBooks 3180 error and help you become a pro in minutes. Let us dive in straight away.

Table of Contents

Error 3180 QuickBooks | Overview

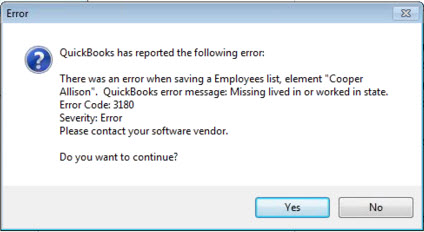

QuickBooks is a highly popularized application because of all the right reasons. Although with regular updates and revisions, the complexity increases. error 3180 QuickBooks is a result of this. This error pops up with the message: “Status code 3180: Status message: There was an error when saving a Sales Receipt.”

QuickBooks 3180 error mainly occurs due to damage or corrupted items of payments. Whenever there is difficulty in saving a cash receipt or memo, this error arises. QuickBooks tracks the overall sales by saving the sales receipts of all products sold everyday. However, error 3180 QuickBooks can put an abrupt stop to this causing accounting issues if not resolved quickly.

Error 3180 QuickBooks | Source

The list of sources of the error is long. These are some of the most common reasons why you see QuickBooks error code 3180 on your screen.

- QuickBooks company file might be corrupted or damaged.

- No vendor is lodged in the sales tariff receipt.

- When one or more than one item has selected a payable account of sales tax as a target.

- Incorrect vendor expense settings can cause error 3180 QuickBooks.

- Unfavorable antivirus settings can give rise to this error.

- Incorrect account settings of unpaid sales tax account can give rise to QuickBooks error 3180.

- When you use a payable account of sales tax to create paid out.

Warning Signs To Look Out For

When error 3180 QuickBooks is popped on your screen, not only does your work slow down but there are other consequences as well. These consequences can worsen if QuickBooks 3180 error is not resolved early. Although at first these symptoms may not seem alarming but it can hurt your business in the long run. These are the warning signs to look out for:

- Unable to save sales receipt.

- System is not responding to inputs

- QuickBooks crashes frequently.

- Error message hit up your screen.

- The system works sluggishly.

QuickBooks 3180 Error | Top Solutions

Every problem has a solution. So does QuickBooks 3180 error. We understand the panic but sit back and relax. Here are some well researched solutions that can make this error go away.

Solution 1: Consolidate QuickBooks Items

When you merge components in QuickBooks all historical transactions, including sales purchases etc. are merged. This helps view the items consolidated and makes it easy to grasp the source of occurrence. This also helps eliminate any duplicate items that may be the reason for error 3180 QuickBooks.

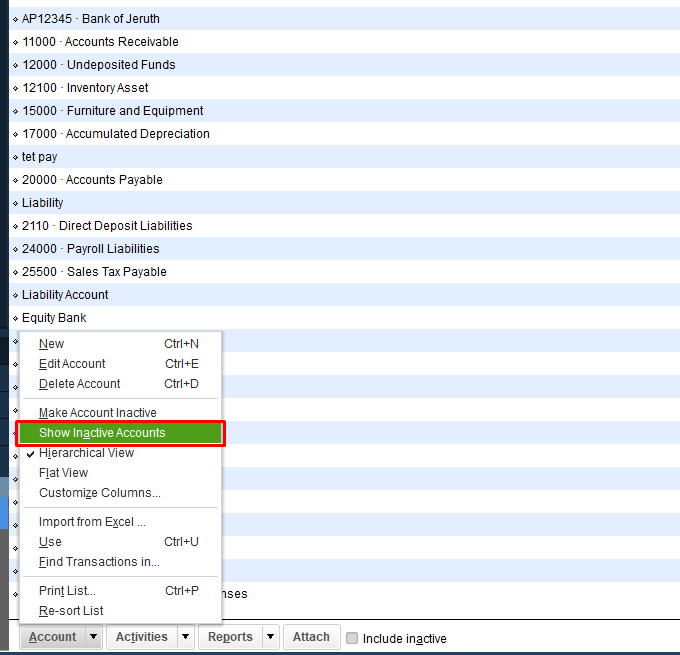

- Open the item menu in the list section of QuickBooks and choose the option include inactive.

- Give the POS payments item a different name.

- Look for payment items of POS & with a right click, choose the option edit items and rename with .old at last.

- Merge duplicate items and select the Option edit item & remove old from the name.

- Hit OK and Yes.

Solution 2: Make Sure A Vendor Is Associated With Every Sales Tax Item

QuickBooks 3180 error can occur in case no vendor is associated with the item of sales tax. When no vendor is embedded in the receipt, the receipt is considered to be rejected causing error 3180 QuickBooks. Follow these steps to ensure no receipt is left without a vendor being assigned to it:

- Tap list tab on QuickBooks desktop.

- In the item section, select option include inactive.

- Categorize the list from A to Z from the type column.

- Finally make sure a tax medium is lodged along with all items .

Also Read: How to Resolve QuickBooks Error 3371: Permanent Fixation Methods

Solution 3: All Financial Methods To Be Recreated Or Renamed

There can be situations when financial methods carry bugs or settings that cause error 3180 QuickBooks to arise. However, this can completely be resolved simply by following these steps:

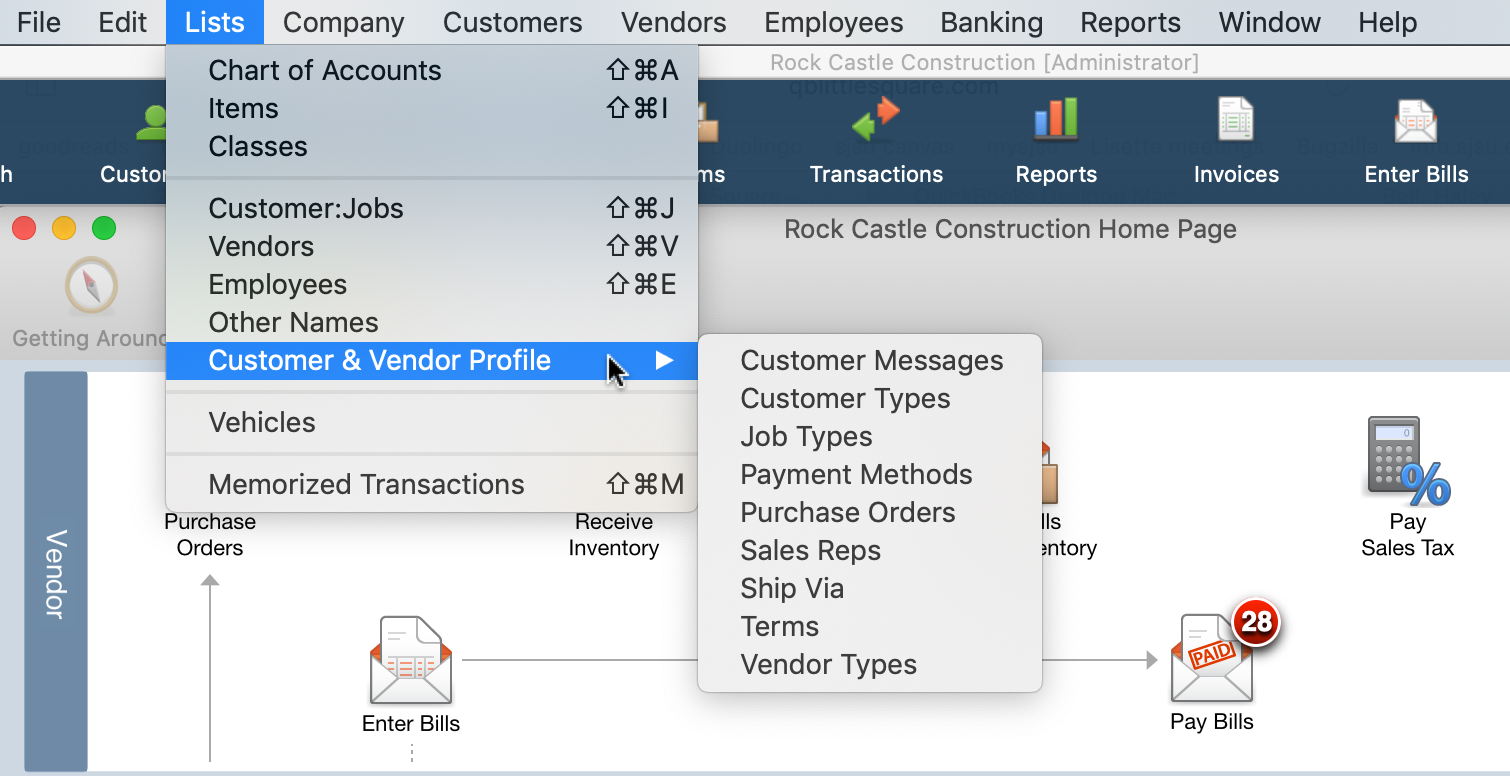

- Open QuickBooks desktop and in the list menu, hit Customer & Vendor Profile Lists.

- Open the payment method list and right click on the cash method.

- Hit the edit payment button and Add letter X in the payment field.

- Right-click on the cash method again and tap the new method.

- Finally, rename it as cash and repeat this with all payment methods.

Solution 4: Ensure Payable Account Of Sales Tax Is Not Used To Pay Out Receipts

When a sales tax payable account is used to create paid out QuickBooks error code 3180 arises. In order to avoid such scenarios, follow these steps:

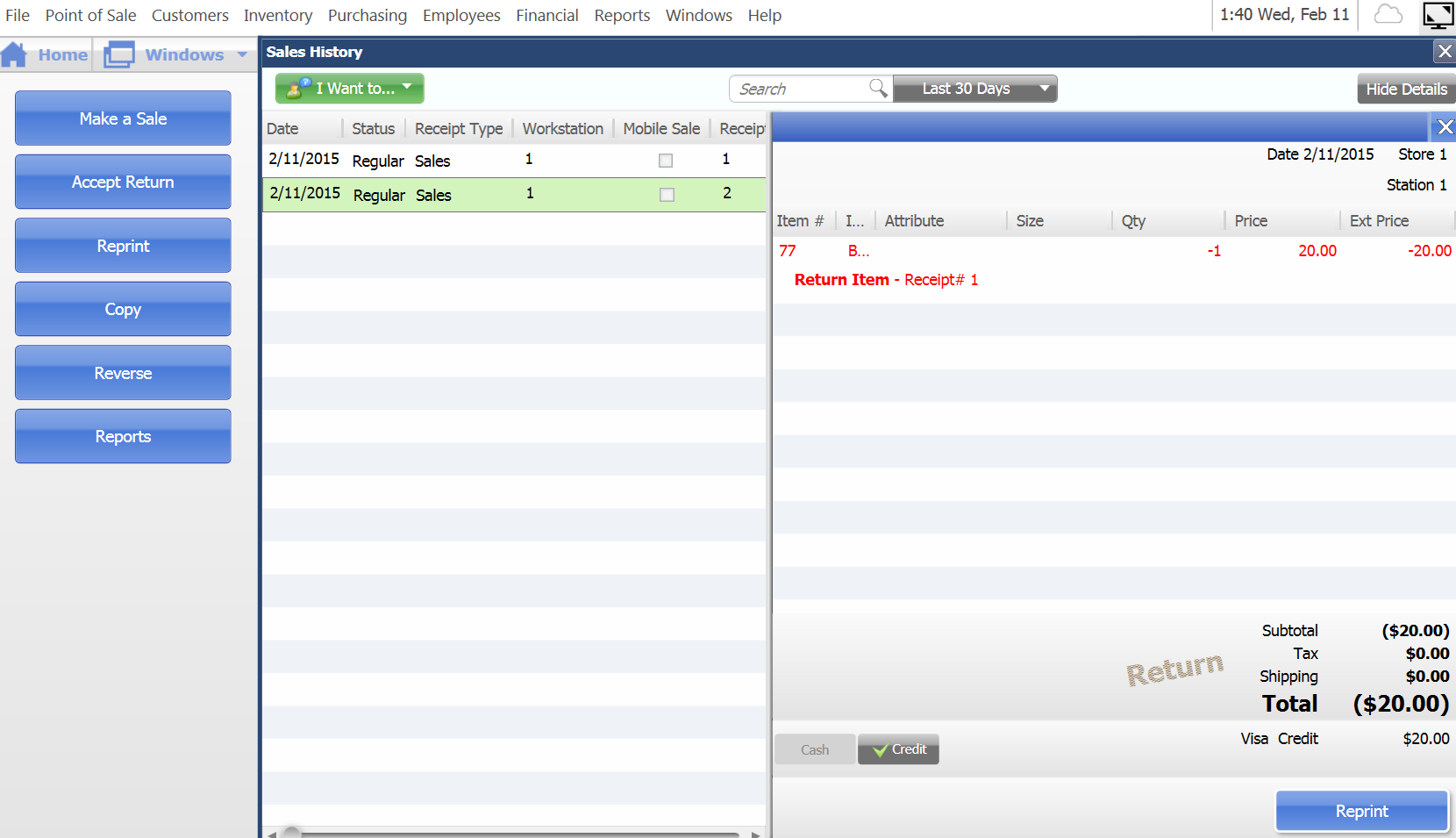

- Go to sales history in QuickBooks POS software.

- Click right on any field.

- In the customize column option, choose QuickBooks status.

- Search for incomplete receipts.

- Select any receipt that is associated with a payable account of sales tariff.

- Tap on reverse receipt.

- Use another account that is not sales payable to recreate the paid out.

Also Read: How to Void a Check in QuickBooks | Easy Methods

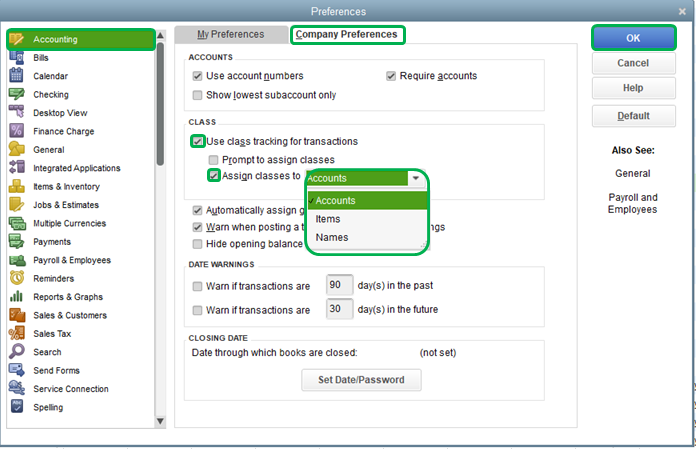

Solution 5: Select the Tax Preference

There can be situations when your tax preference is not in favor of your receipt causing 3180 errors. Make sure to check and select your tax preference as suitable.

- Access QuickBooks POS and navigate to the File menu.

- From the preferences tab, choose Company.

- Within the Financial section, select Accounts.

- Check mark the check box :Basic and Advanced

- Ensure that QBs Sales Tax Payable is listed in the sales tax row.

Also Read: QBO Test Drive: Free Online Demo of Advanced QuickBooks

Conclusion

QuickBooks is a popular accounting software. However, it is still prone to many errors that can arise even because of the smallest mistakes. Error 3180 QuickBooks is an example of one such error. Nonetheless, getting rid of these errors is simple once you learn the procedure. All in all, we hope we were able to help you resolve this error through our blog. However, if you have some unanswered queries, you can always contact our QuickBooks experts. We are available at any time for your service. Send us a message so we can handle your problems.

Frequently Asked Questions (FAQs):

Q: Which QuickBooks plan is right for me?

A: There are a total of four monthly plans QuickBooks offer.

- Simple start

- Essentials.

- Plus

- Advanced

All plans offer different features that can be seen on the official website of intuit. We recommend you look at all plans and their features and select the one suitable for your business, budget and needs. Moreover, you can upgrade these plans once you grow and move forward.

Q: What hardware are supported by QuickBooks desktop POS?

A: All hardware in your system is tested to make sure it works with the version of QuickBooks POS. The customer support team can help with hardware issues and setup. Here’s a list of all hardware support by point of sale software:

- Receipt printer

- Tag printer

- Cash drawers

- Barcode scanners

- PIN Pads (purchased from intuit)

- Pole display

- Card swipe

- Physical inventory scanners